Taurus is proud to support ISSA’s 6th annual Distributed Ledger Technology (DLT) survey, alongside Accenture and Broadridge. The survey includes responses from 355 institutions across four continents, including banks, custodians, central securities depositories (CSDs), and market infrastructure providers.

If you're building or scaling a digital asset strategy, this survey offers a data-driven view of where the industry is heading. Here are the core findings that define the current state of digital asset adoption in 2025.

1. Tokenization Has Become a Strategic Priority

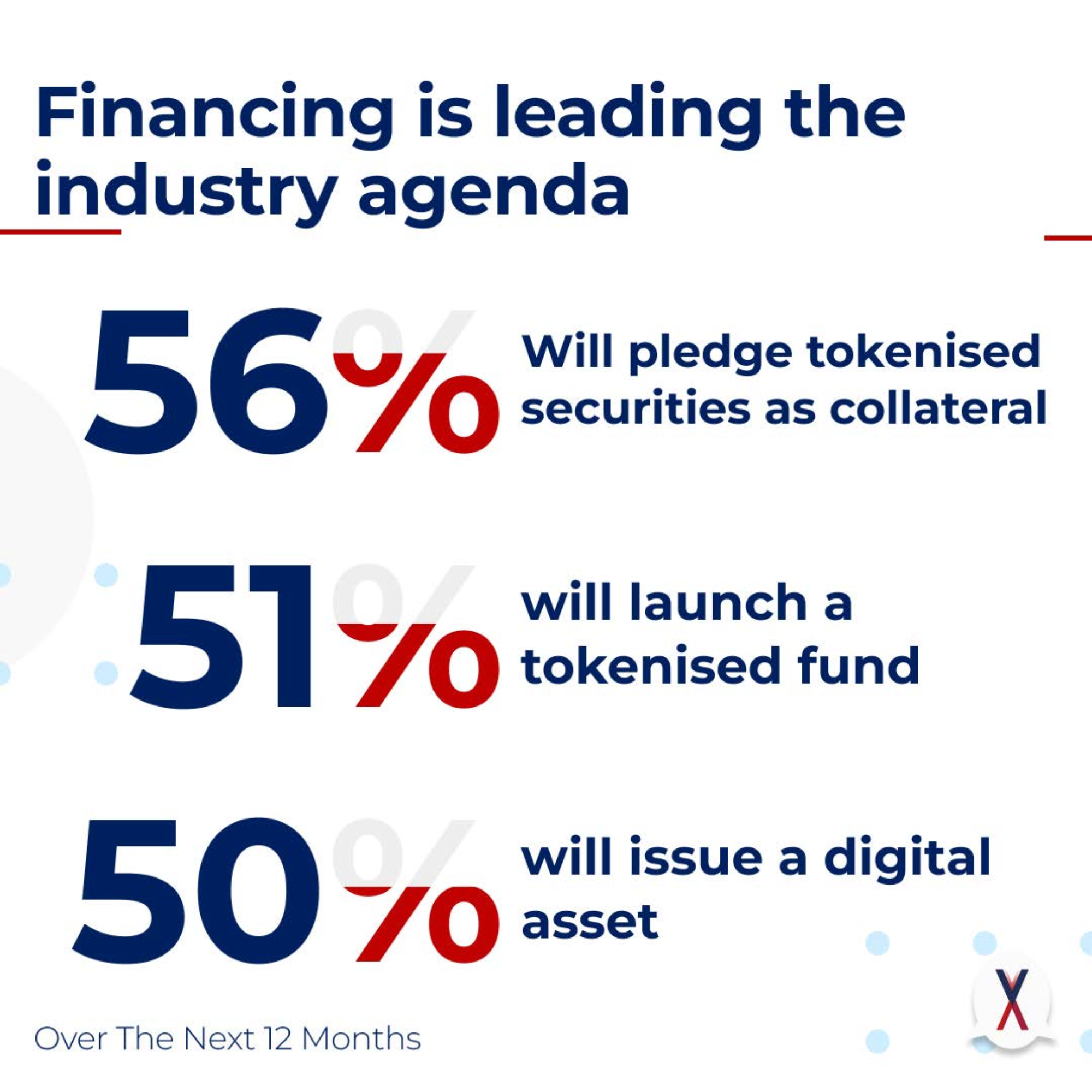

Institutions are shifting from experimentation to execution. Over the next 12 months:

- 56% will use tokenized securities as collateral

- 51% plan to launch tokenized funds

- 50% expect to issue new digital assets

This marks a shift from exploration to deployment. Tokenization is being used to enhance collateral mobility, enable new fund structures, and support asset issuance. The emphasis is on improving existing financial workflows using digital asset capabilities.

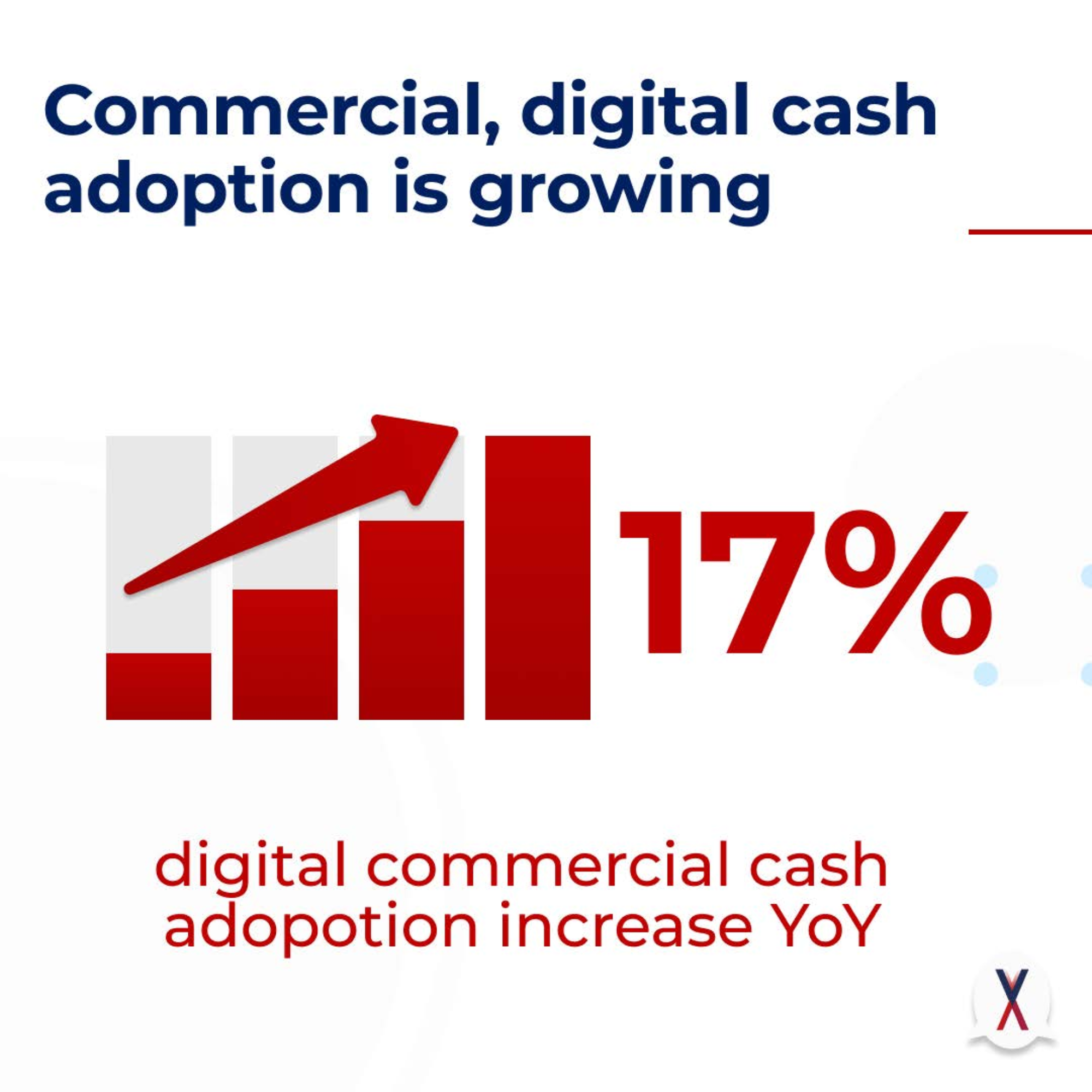

2. Adoption of Digital Commercial Cash Is Increasing

There has been a 17% year-over-year increase in the use of digital commercial cash. This trend indicates growing institutional confidence and reflects a shift toward scalable, real-time financial operations.

3. Intraday Liquidity Is the Top Use Case

85% of respondents identify intraday liquidity as the most valuable benefit of digital assets and DLT. The ability to accelerate cash and collateral movements is reducing transaction costs and improving liquidity management across the board.

85% of respondents identify intraday liquidity as the most valuable benefit of digital assets and DLT. The ability to accelerate cash and collateral movements is reducing transaction costs and improving liquidity management across the board.

4. Bonds, Money Market Funds, and Stablecoins Lead Production Use

These three asset classes are the most commonly used in live environments. Their usage has moved beyond pilot programs and is now supporting operational processes in issuance, trading, and post-trade.

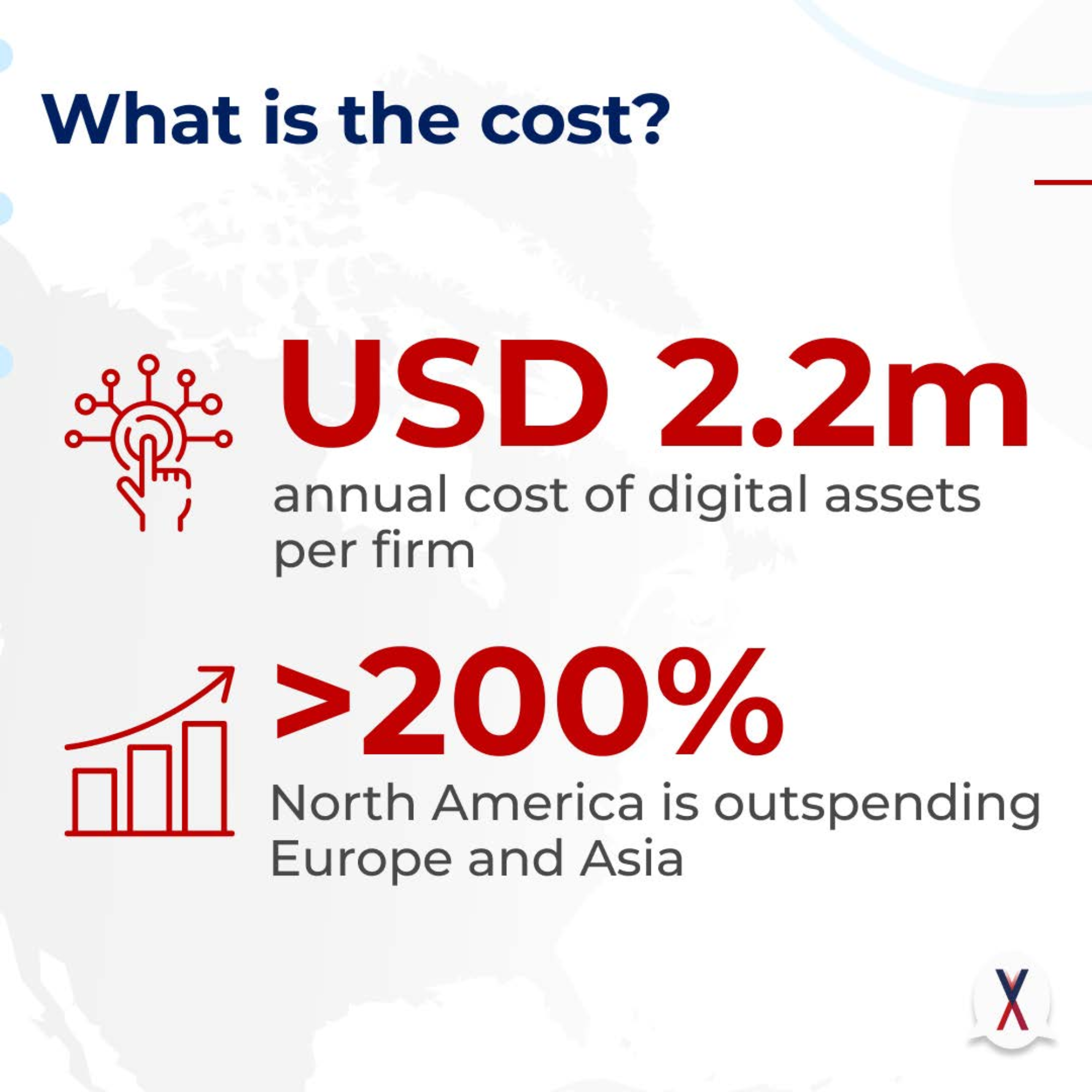

5. Investment Levels Are Rising

On average, firms are allocating 2.2 million dollars annually to digital asset initiatives. North America is leading, with firms in the region spending more than double the amounts reported in Europe and Asia. This is a clear indicator of regional momentum and competitive positioning.

On average, firms are allocating 2.2 million dollars annually to digital asset initiatives. North America is leading, with firms in the region spending more than double the amounts reported in Europe and Asia. This is a clear indicator of regional momentum and competitive positioning.

6. Liquidity Constraints Remain a Major Challenge

Limited liquidity is slowing progress in digital asset markets:

Limited liquidity is slowing progress in digital asset markets:

-

33% of firms view it as a direct obstacle

-

59% say it is a key barrier to further development

The growth of secondary markets and improved asset interoperability will be necessary to address this issue.

7. DLT Adoption Is Being Driven by Business Teams

Digital asset initiatives are increasingly led by business functions rather than technology or compliance teams:

Digital asset initiatives are increasingly led by business functions rather than technology or compliance teams:

-

55% of momentum originates from sales and business development

-

48% comes from C-suite and executive leadership

This shift signals a growing focus on commercial outcomes and revenue generation.

Conclusion

The 2025 DLT survey provides a grounded view of how digital assets are being deployed today. Financial institutions are prioritizing tokenization, scaling digital cash usage, and focusing on liquidity improvements. At the same time, adoption is moving out of innovation teams and into the core of business strategy.

These benchmarks offer a valuable guide for institutions evaluating how and where to invest in digital asset capabilities. The full results are available in the official report. Download the full report here.

Taurus-PROTECT Custody

Taurus-PROTECT Custody

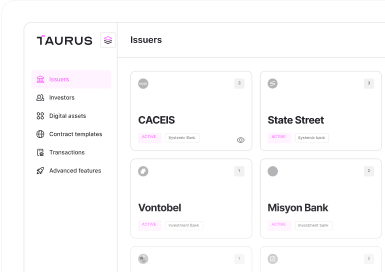

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

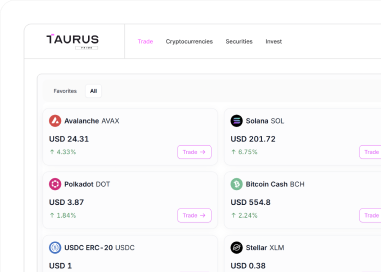

Taurus-PRIME Trading

Taurus-PRIME Trading

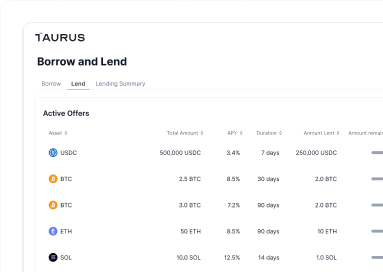

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral