GENEVA, 09 SEPTEMBER 2025—Taurus SA, a FINMA-regulated Swiss institutional-grade digital asset infrastructure provider, today announces the strategic expansion of its operations with the opening of a new office in Brazil. This move reinforces Taurus’ technology leadership and deepens its market presence in Latin America, particularly in Brazil, where the company already serves multiple clients and partners.

The new office is led by Bruno Reis, CEO for Brazil, who brings over 20 years of experience in financial markets and technology at global leaders such as Citi, Oracle, SAP, and Neoway. Until recently, Mr. Reis was the co-founder and CEO of Ali, one of Brazil’s leading fintechs, successfully exiting to BTG Pactual in early 2025. Mr. Reis brings a combination of technology expertise, market knowledge, and proven execution in the Latin American financial sector.

"The evolving regulatory framework in Brazil will enable financial institutions to offer digital assets at scale soon," said Bruno Reis. "I am proud to lead Taurus’ efforts in building a strong franchise across Brazil and Latin America, where we have been actively engaging with regulators and clients to drive adoption."

Brazil’s financial ecosystem has witnessed significant initiatives related to digital assets in recent years, including the central bank’s Drex project and other pioneering programs. Regulatory clarity on cryptocurrencies is expected to be finalized by late 2025, further catalyzing growth and innovation in the region.

Lamine Brahimi, Co-founder and Managing Partner at Taurus, commented on the expansion, "This new chapter in Brazil marks Taurus’ ongoing dedication to advancing the institutional adoption of digital assets while delivering cutting-edge technology and regulatory compliance excellence across key global markets."

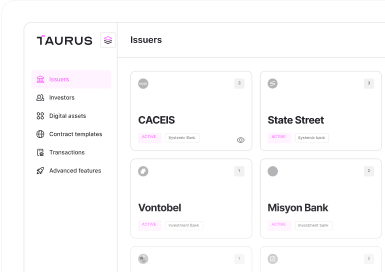

Taurus has established itself as the trusted digital asset infrastructure provider for leading banks and financial institutions worldwide. The company maintains strategic partnerships with Deutsche Bank, CACEIS, Santander, and State Street, among others. In February 2023, Taurus successfully closed a $65 million Series B funding round led by prominent investors including Arab Bank Switzerland, UBS/Credit Suisse, Investis, and Pictet.

About Taurus SA

Founded in 2018, Taurus is a Switzerland-based financial technology company providing enterprise-grade digital asset infrastructure, with 11 offices around the world. It offers services for issuing, storing, and trading all types of digital assets, including cryptocurrencies, tokenized assets, NFTs, and digital currencies. Additionally, Taurus operates a marketplace for private assets and tokenized securities and is a securities firm regulated and supervised by FINMA. For more information, visit https://www.taurushq.com/

About Taurus’ platform and products

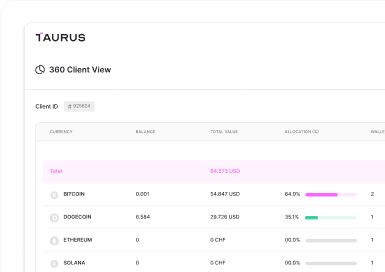

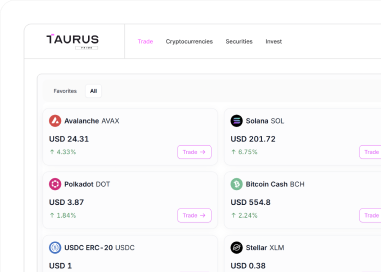

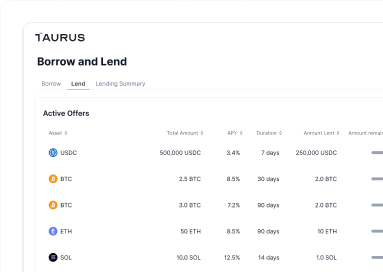

Depending on their business model, strategy, and risk tolerance, Taurus' clients can seamlessly manage cryptocurrencies, tokenized securities, and stablecoins. Taurus’ product portfolio is composed of Taurus-PROTECT™, the leading secure storage solution in Europe which is currently used by more than 35 financial institutions and corporations. Taurus-CAPITAL™ allows clients to issue and manage NFTs and tokenized assets on public and private blockchains, as well as interact with any smart contract. The regulated marketplace for digital assets, TDX™, is connected to Taurus-PROTECT™ and Taurus-CAPITAL™. All products leverage Taurus’ blockchain node infrastructure, Taurus-EXPLORER™, which provides a unified API and reliable broadcasting algorithms to interface securely with over 35 blockchain networks. For more information, please visit: https://www.taurushq.com

Taurus-PROTECT Custody

Taurus-PROTECT Custody

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

Taurus-PRIME Trading

Taurus-PRIME Trading

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral