New York, 29 October 2025—Taurus SA, a FINMA-regulated Swiss provider of institutional-grade digital asset infrastructure, today announced the expansion of its global presence with the opening of a new office in the United States. Following the launch of its first North American office in Vancouver, Canada, in 2023, this milestone underscores Taurus’ leadership in digital asset technology and its deepening commitment to the North American market.

Taurus’ U.S. operations will be led by Zack Bender, who will be based in New York. With more than a decade of experience across global institutions and startups, Bender brings a unique combination of expertise in technology, capital markets, and sales developed at Tier-1 firms including Fiserv and Swift.

Commenting on the U.S. expansion, Bender said: “The GENIUS and Clarity Acts, together with the repeal of SAB121, pave the way for financial institutions and large corporates to scale digital asset activities. We expect significant adoption in the coming quarters, and I am excited to support clients with one of the most advanced infrastructures in the world while building Taurus’ presence in the U.S. market.”

Taurus has been monitoring U.S. regulatory and market landscape actively since 2020 and already serves several American banks and market makers. The company sees strong momentum under the new U.S. administration, which has positioned the country to become a global hub for digital assets.

Lamine Brahimi, Co-founder and Managing Partner at Taurus, added: “Establishing a U.S. office has always been part of our strategic priorities. With Canada as our initial North American foothold since 2023, today’s announcement reflects our commitment to serving the most sophisticated financial institutions directly from the United States, now that the regulatory environment fully enables digital asset services.”

Taurus has established itself as the trusted digital asset infrastructure provider for leading banks and financial institutions worldwide. The company maintains strategic partnerships with partnerships with Deutsche Bank, CACEIS, Santander, and State Street among others. In February 2023, Taurus successfully closed a $65 million Series B funding round led by prominent investors including Arab Bank Switzerland, UBS/Credit Suisse, Investis, and Pictet.

About Taurus SA

Founded in 2018, Taurus is a Switzerland-based financial technology company providing enterprise-grade digital asset infrastructure, with 13 offices around the world. It offers services for issuing, storing, and trading all types of digital assets, including cryptocurrencies, tokenized assets, NFTs, and digital currencies. Additionally, Taurus operates a marketplace for private assets and tokenized securities and is a securities firm regulated and supervised by FINMA. For more information, visit https://www.taurushq.com

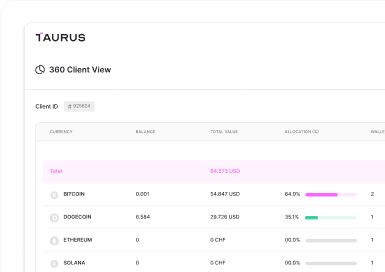

Taurus-PROTECT Custody

Taurus-PROTECT Custody

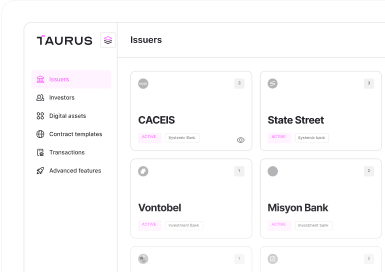

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

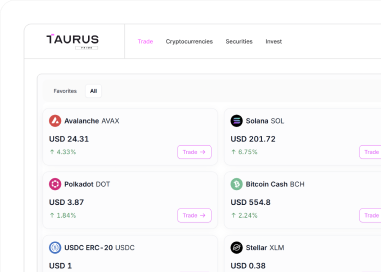

Taurus-PRIME Trading

Taurus-PRIME Trading

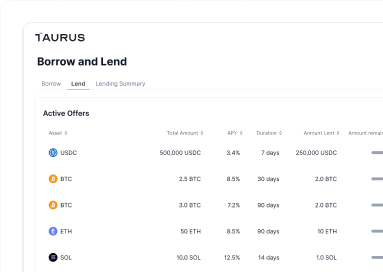

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral