Taurus, a global leader in digital asset infrastructure, has successfully completed its ISAE 3402 Type II audit for the fourth year in a row. The resulting assurance report, issued by Deloitte following an extensive independent audit, confirms that Taurus’ operations and IT service delivery meet the rigorous control standards defined under ISAE 3402.

The ISAE 3402 Type II report is an internationally recognized standard for evaluating and reporting on controls at service organizations. Developed by the International Auditing and Assurance Standards Board (IAASB), part of the International Federation of Accountants (IFAC), it enables customers and auditors to assess the effectiveness of internal controls over a defined audit period.

"This assurance report is a clear signal that our controls are working as intended. From IT infrastructure to key management, every layer is built to withstand real-world risks like phishing, supply chain attacks, natural disasters, and insider threats," said Jean-Philippe Aumasson, CSO of Taurus.

Taurus is one of the most heavily regulated technology firms in the world. It is licensed as a Securities Firm by FINMA, Switzerland’s financial authority, and holds the ISO/IEC 27001 certification for information security.

About Taurus SA

Taurus SA is a Swiss Fintech, founded in April 2018, that provides enterprise-grade digital asset infrastructure to issue, custody, and trade any digital assets, including cryptocurrencies, tokenized assets, NFTs, and digital currencies. Taurus is a global leader in the banking segment, entrusted by the full spectrum of financial institutions: systemic banks, universal banks, online banks, crypto-banks, private banks, and broker-dealers. Taurus also operates a marketplace for private assets and tokenized securities. Taurus SA is a securities firm supervised and regulated by FINMA. TDX is an organized trading facility operated by Taurus.

About Taurus’ platform and products

Depending on their business model, strategy, and risk tolerance, Taurus' clients can seamlessly manage cryptocurrencies including staking, digitize and tokenize any type of asset on any standard end-to-end, and process digital currencies of their choice. Taurus’ product portfolio is composed of Taurus-PROTECT™, the leading secure storage solution in Europe which is currently used by more than 30 financial institutions and corporations. Taurus-CAPITAL™ allows clients to issue and manage tokenized assets on public and private blockchains, as well as interact with any smart contract. The regulated marketplace for digital assets, TDX™, is connected to Taurus-PROTECT™ and Taurus-CAPITAL™. All products leverage Taurus’ blockchain node infrastructure, Taurus-EXPLORER™, which provides a unified API and reliable broadcasting algorithms to interface securely with blockchain networks. For more information, please visit: www.taurushq.com

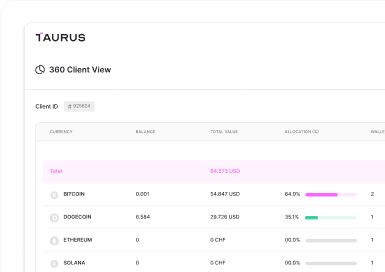

Taurus-PROTECT Custody

Taurus-PROTECT Custody

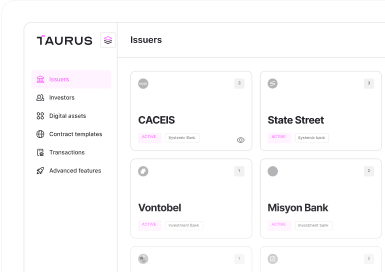

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

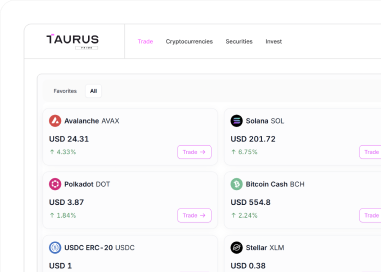

Taurus-PRIME Trading

Taurus-PRIME Trading

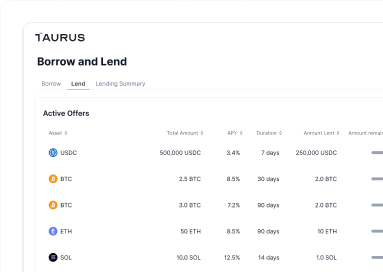

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral