Geneva, Switzerland, 26.06.2025 – Taurus SA, the digital asset infrastructure leader, announces the deployment of the first private stablecoin contract. Unlike legacy stablecoins, it offers confidentiality, untraceability, and anonymity, yet permits access to authorized parties (issuers, regulators, law enforcement).

This achievement complements Taurus’ release of the first open-source private security token in Q1 2025, bringing on-chain privacy to both the cash-leg and the security-leg of digital transactions. Built atop the Aztec Network, this stablecoin contract combines the confidentiality guarantees of zero-knowledge proofs with the compliance features expected from leading stablecoins.

"This marks a major step forward for stablecoins,” said JP Aumasson, Chief Security Officer at Taurus. “We showed that it’s possible to protect the privacy and security of stablecoin users while retaining the features of industry-standard stablecoins. This addresses concerns that we’ve repeatedly heard from banks looking at issuing stablecoins, central banks, and regulators."

Arnaud Schenk, Executive Director of the Aztec Network board, commented: “Enforced global transparency of public blockchains limits the real-world adoption of stablecoins. Practical adoption for payroll, intra-company transfers, or day-to-day payments simply can't happen if every transaction remains visible to all and immutably inscribed on a widely available ledger. Aztec’s zero-knowledge Layer 2 is the only platform that delivers both airtight privacy for users and granular issuer-defined controls baked directly into the token."

A timely step as regulatory clarity emerges

This deployment follows a recent major milestone in stablecoin issuance: the US Senate passed the GENIUS Act, a landmark bill establishing a legal framework for the issuance and oversight of stablecoins. The timing couldn’t be more relevant—stablecoin supply has surged past $250 billion, a 1200% growth since 2020.

Taurus expects the total stablecoin supply to reach $1–2 trillion by 2030 as demand increases across institutional and consumer markets, pushed by favorable regulation. Taurus’ privacy-preserving contract addresses the growing need for compliant, secure digital cash solutions in this expanding space.

All major stablecoin functionalities covered

This breakthrough from Taurus combines the confidentiality of transfers with the compliance features required by regulators. The smart contract covers critical functionalities required by a stablecoin. In particular, it supports Circle USDC’s core features:

-

Centralized, admin-controlled mint and burn

-

Pause/unpause capabilities to halt transfers in case of an emergency

-

Address blacklisting to enforce sanctions and other compliance needs

-

Events logging, creating a verifiable audit trail

Yet unlike traditional stablecoins, all balances and transfers are encrypted and only readable by authorized parties (such as issuers and regulators). This prevents unauthorized parties from monitoring wallets, reverse-engineering investment strategies, or physically targeting high-value users.

With this private stablecoin contract, financial institutions, for whom privacy is a concern, will be able to issue stablecoins in payment or treasury applications while ensuring privacy of transfers and of the asset distribution and retaining regulatory observability.

Open technology

The stablecoin smart contract is based on Taurus’ open-source private security token, built atop the CMTAT security token standard. Its source code is available at https://github.com/taurushq-io/private-CMTAT-aztec/tree/stablecoin.

The smart contract is deployed on Aztec’s testnet at https://aztecexplorer.xyz/address/0x1ca1cf2f6b636d27d7580591950fb5276828abb381d3e648118a3c4129402e23 (as of June 24th; future testnet updates may not retain this link).

About Taurus SA

Taurus SA is a Swiss company, founded in April 2018, that provides enterprise-grade digital asset infrastructure to issue, custody, and trade any digital assets: cryptocurrencies, tokenized assets, NFTs, and digital currencies. With more than a 50% market share in Switzerland, it is a global leader in the banking segment, entrusted by the full spectrum of financial institutions: systemic banks, universal banks, online banks, crypto-banks, private banks, and broker-dealers. Taurus also operates a marketplace for private assets and tokenized securities. For further information on Taurus: please visit https://www.taurushq.com.

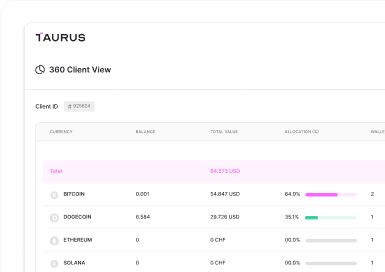

Taurus-PROTECT Custody

Taurus-PROTECT Custody

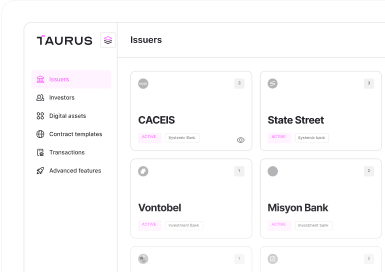

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

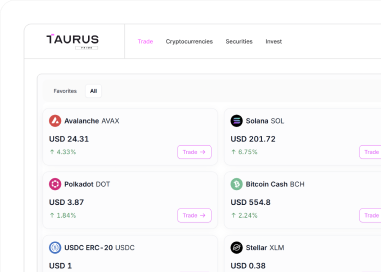

Taurus-PRIME Trading

Taurus-PRIME Trading

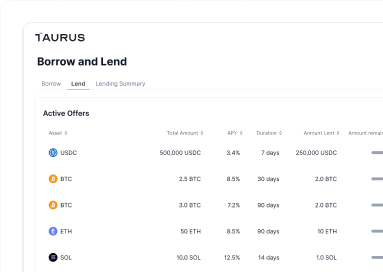

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral