Stablecoins have become one of the fastest-growing segments of digital assets. Global supply has passed USD 251 billion, and usage continues to grow across payments, settlement and treasury operations. Our research shows this trend will accelerate, with stablecoin supply projected to reach USD 1–2 trillion by 2030 and institutional digital cash adoption growing 17% annually.

To support this accelerating demand, Taurus has integrated Circle ARC and the ADI DLTs into its platform including tokenization (Taurus-CAPITAL), custody (Taurus-PROTECT), and Taurus-NETWORK. These integrations give financial institutions the opportunity to extensively test Circle ARC and ADI and be ready upon their go-live. Taurus ultimately provides its clients with more choice, more flexibility, and more global rails to operate stablecoins across various currencies and jurisdictions.

Circle ARC: strengthening governance for USDC and EURC

Circle ARC adds a recognized governance and compliance layer to USDC, EURC and future Circle stablecoins. By integrating ARC, Taurus, which was already part of the early bird program announced on October 28, enables institutions to use regulated USD and EUR stablecoins for settlement, liquidity and payments within the same workflows and controls they already rely on. This brings a straightforward, compliant path to using stablecoins at scale.

ADI: bringing a regulated AED stablecoin and new regional access

Taurus also integrated the full ADI ecosystem from issuance to custody, which includes a fully regulated AED-backed stablecoin issued in the UAE. Going to production will be as easy as a configuration switch. ADI aims to bring one billion people on-chain by 2030 across the Middle East, Asia and Africa, supported by ADI Chain, a public network active in more than 20 countries.

For institutions, this introduces a new regionally anchored, compliant currency option with instant 24/7 settlement and strong sovereign backing.

More rails, one platform

With Circle ARC and ADI now supported across our platform, financial institutions gain:

- strengthened access to USD, EUR and AED stablecoins under clear regulatory frameworks

- possibility to use the aforementioned stablecoins as collateral within Taurus-NETWORK

- multiple rails, allowing institutions to choose the networks and currencies that best fit their business

- a unified operational model for custody, issuance, transfers and settlement.

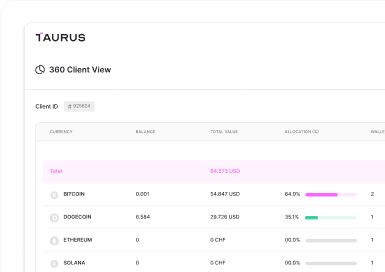

Taurus-PROTECT Custody

Taurus-PROTECT Custody

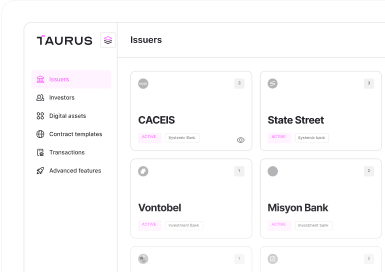

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

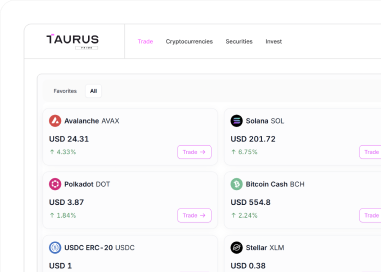

Taurus-PRIME Trading

Taurus-PRIME Trading

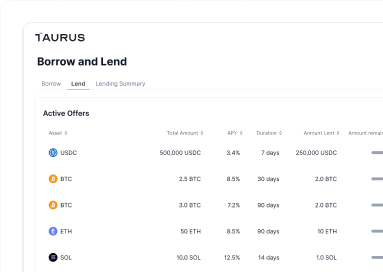

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral