28.03.2025, Geneva — Taurus, a leading digital asset infrastructure provider, has been named World’s Best for Custody Services by Euromoney. This prestigious recognition reflects not only the technical sophistication of Taurus’ solutions but also its strategic role in helping financial institutions integrate digital assets into their operations.

Founded in 2018, Taurus delivers the industry’s most comprehensive platform, combining enterprise-grade technology with unmatched regulatory compliance in a single, unified solution. The world’s most stringent financial institutions trust Taurus to securely store, tokenize, issue, and trade digital assets with ease.

Taurus’ platform includes:

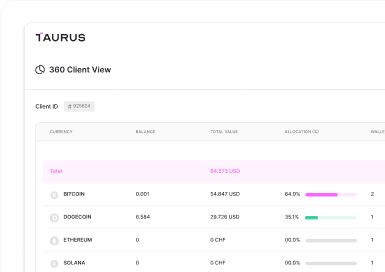

- Taurus-PROTECT: Multi-layered custody solution that supports different storage types (hot, warm, cold) to meet the needs of institutions looking for banking-grade security.

- Taurus-CAPITAL: Tokenization solution that allows financial institutions to issue and manage any digital securities

- Taurus-EXPLORER: Real-time connectivity to over 25 blockchain protocols, enabling seamless integration across both public and permissioned blockchains.

- TDX: Regulated marketplace for tokenized private assets, providing liquidity to previously illiquid markets.

By combining these capabilities in one platform, Taurus makes it easier for institutions to adopt digital assets without compromising security, flexibility, or compliance.

“We’re honored to be named 'The World's Best for Custody Services' by Euromoney,” said Lamine Brahimi, co-founder and managing partner at Taurus. “It’s a clear signal that Taurus is setting the standard in institutional digital asset infrastructure and delivering the most complete, future-ready platform on the market.”

“This recognition from one of the most respected voices in global banking reinforces our position as a trusted partner for financial institutions worldwide. As digital assets continue to create new opportunities in global finance, we remain dedicated to providing secure, compliant, and innovative custody solutions that enable institutions to participate in this economy."

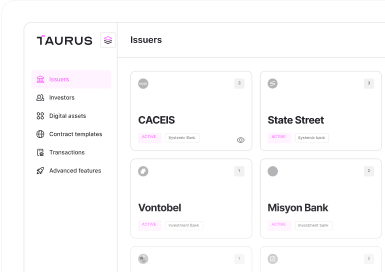

With ten offices across Europe, North America and the Middle East, and more than 30 institutional clients, including State Street, CACEIS, Deutsche Bank, Zand Bank, and Misyon Bank, Taurus has rapidly established itself as the leader in the digital asset space.

As demand for secure, regulated access to digital assets increases, Taurus is positioned as a key infrastructure partner for institutional adoption.

About Taurus

Founded in 2018, Taurus is a Switzerland-based financial technology company providing enterprise-grade digital asset infrastructure. It offers services for issuing, storing, and trading all types of digital assets, including cryptocurrencies, tokenized assets, NFTs, and digital currencies. Additionally, Taurus operates a marketplace for private assets and tokenized securities and is a securities firm regulated and supervised by FINMA. For more information, visit https://www.taurushq.com/

Taurus-PROTECT Custody

Taurus-PROTECT Custody

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

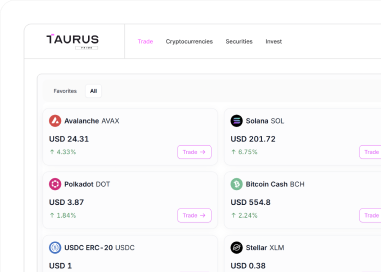

Taurus-PRIME Trading

Taurus-PRIME Trading

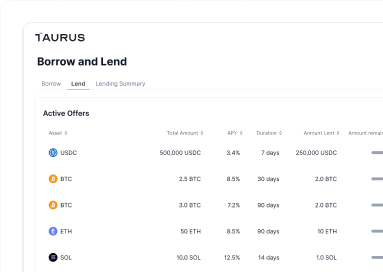

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral