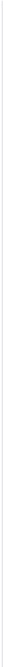

The most reliable way to manage digital assets

Taurus offers enterprise-grade custody, tokenization, and trading solutions through a fully integrated, modular platform.

One platform. Any digital asset

Custody, tokenize, and trade

digital assets on a platform

built for scale.

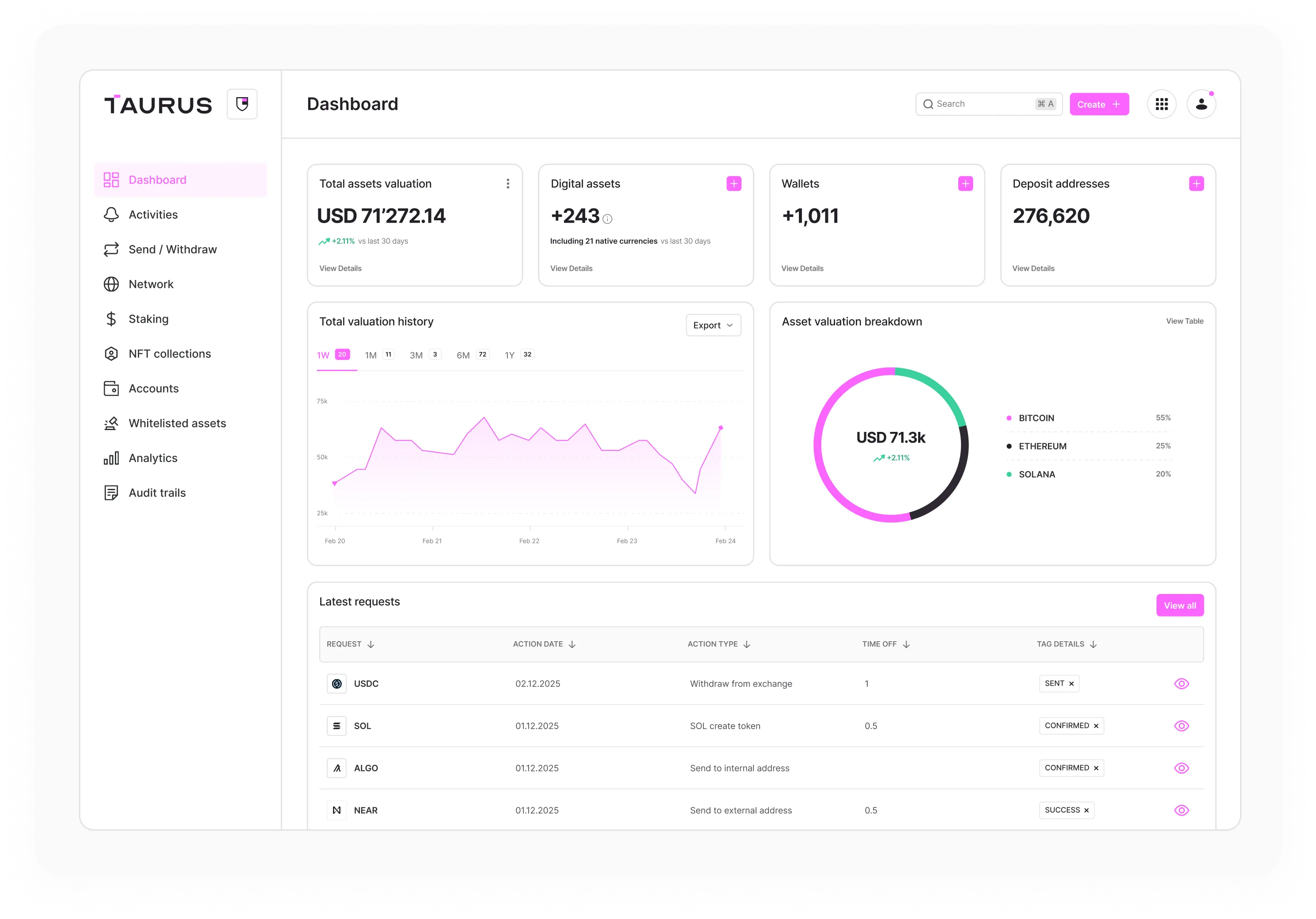

Custody all types of digital assets

with ultra secure hot, warm, and cold storage.

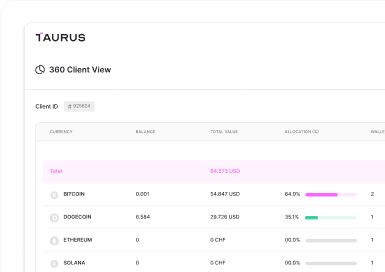

Issue and manage tokenized assets through their full lifecycle with the widest blockchain and smart contract coverage.

difference

Custody, tokenization, trading, network:

collateral management and settlement

100% owned IP and home-made.

Any blockchain, any smart contract.

Managed services, on-premise,

and hybrid installation.

A scalable platform with the broadest use case

coverage: cryptocurrencies, tokenized securities,

and digital currencies.

API-first platform, trusted by systemic banks.

Robust infrastructure that scales without

compromising speed or security.

FINMA, DORA compliant.

Scrutinized like a bank.

Banks, exchanges, and liquidity providers

On-chain and fiat networks

Zero network operator counterparty risk

ISO 27001, ISAE 3402 Type II

Trade from your cold storage

Taurus-PROTECT Custody

Taurus-PROTECT Custody

Taurus-CAPITAL Tokenization

Taurus-CAPITAL Tokenization

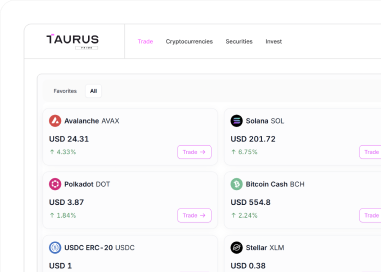

Taurus-PRIME Trading

Taurus-PRIME Trading

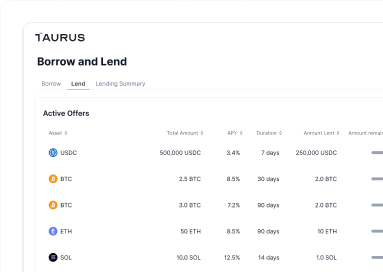

Taurus-NETWORK Collateral

Taurus-NETWORK Collateral