built for institutions

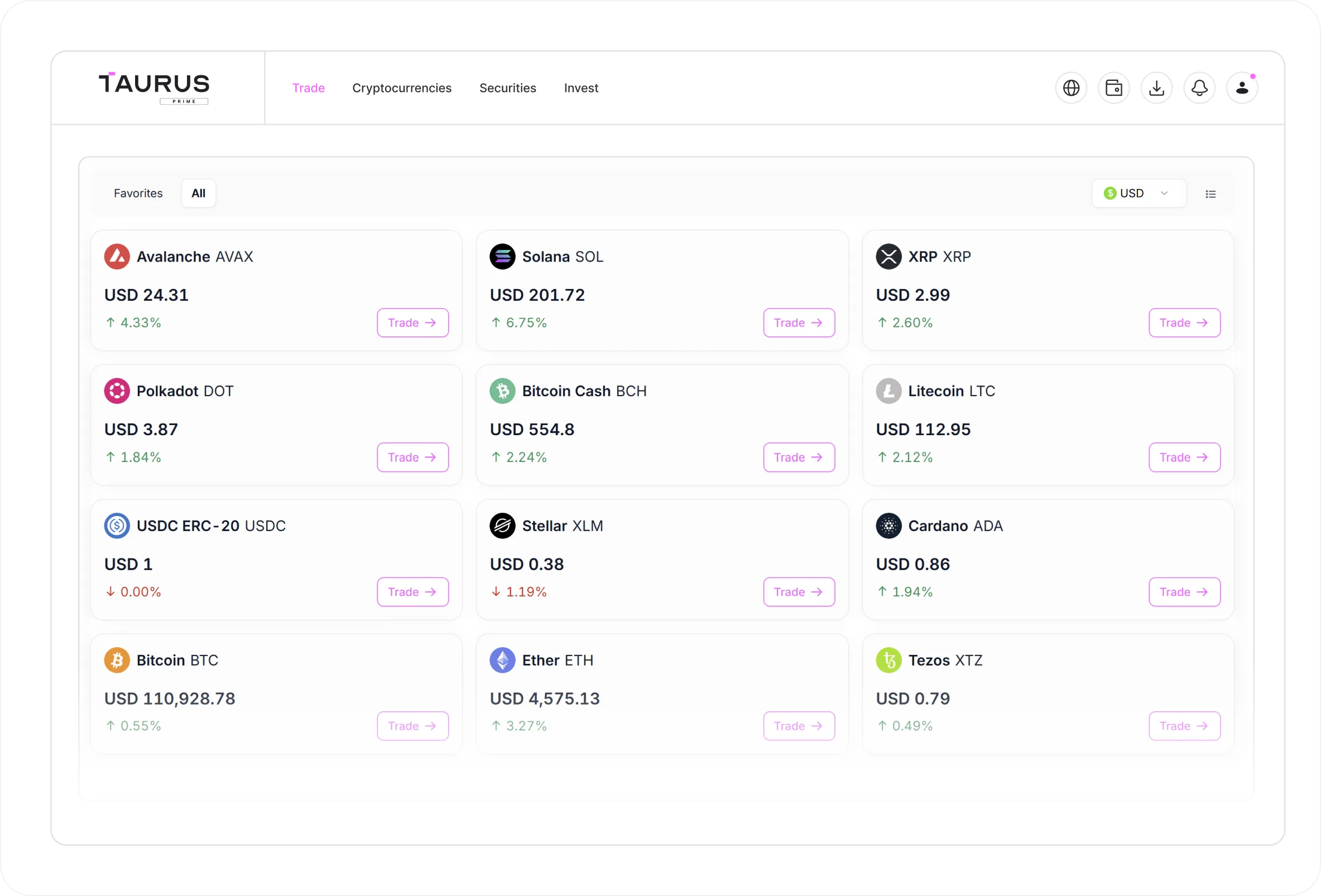

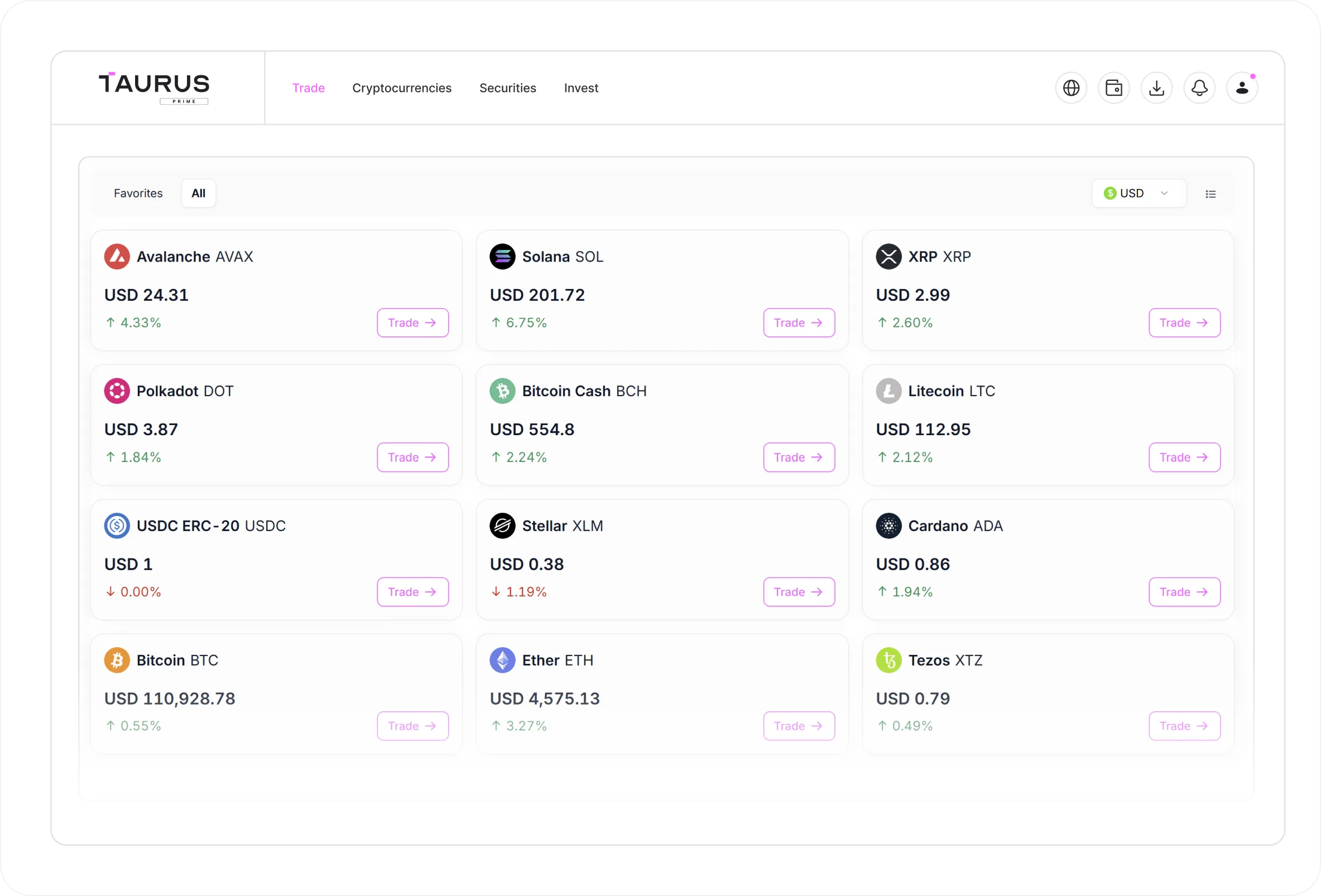

Access the best of digital assets markets: wide asset coverage, banking-grade security, and deep liquidity.

Access the best of digital assets markets: wide asset coverage, banking-grade security, and deep liquidity.

Why financial institutions trade with Taurus-PRIME

FINMA regulated securities firm

Banking-grade security: built on Taurus custody technology

Best execution algorithms, adaptive fees schedule

All securities types: equity, debt, funds. Corporate-actions ready

Secondary markets available with PRIME organized trading facility

Auctions, continuous trading, or OTC based on asset liquidity

API-first design. FIX, REST, Websocket, voice / chat available

Trade execution: RFQ, Limit, TWAP

Quotes in fiat (USD, EUR, CHF) and stablecoins (USDC, USDT, EUROC)

Trade from your cold storage with Taurus-NETWORK

With your own existing trading solution and OMS

Fully API-ready

Standard for risk assurance and internal controls

Top-tier security standard for HSM devices

CMTA Digital Assets Custody Standard, ensuring safe custody procedures and technology security

The globally trusted standard for information security

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Access the best of digital assets markets: wide asset coverage, banking-grade security, and deep liquidity

Why financial institutions trade with Taurus-PRIME

FINMA regulated securities firm

Banking-grade security: built on Taurus custody technology

Best execution algorithms, adaptive fees schedule

All securities types: equity, debt, funds. Corporate-actions ready

Secondary markets available with PRIME organized trading facility

Auctions, continuous trading, or OTC based on asset liquidity

API-first design. FIX, REST, Websocket, voice / chat available

Trade execution: RFQ, Limit, TWAP

Quotes in fiat (USD, EUR, CHF) and stablecoins (USDC, USDT, EUROC)

Trade from your cold storage with Taurus-NETWORK

With your own existing trading solution and OMS

Fully API-ready

Standard for risk assurance and internal controls,

Top-tier security standard for HSM devices

CMTA Digital Assets Custody Standard, ensuring safe custody procedures and technology security

The globally trusted standard for information security

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Why financial institutions trade with Taurus-PRIME

FINMA regulated securities firm

Banking-grade security: built on Taurus custody technology

Best execution algorithms, adaptive fees schedule

All securities types: equity, debt, funds. Corporate-actions ready

Secondary markets available with PRIME organized trading facility

Auctions, continuous trading, or OTC based on asset liquidity

API-first design. FIX, REST, Websocket, voice / chat available

Trade execution: RFQ, Limit, TWAP

Quotes in fiat (USD, EUR, CHF) and stablecoins (USDC, USDT, EUROC)

Trade from your cold storage with Taurus-NETWORK

With your own existing trading solution and OMS

Fully API-ready

Standard for risk assurance and internal controls

Top-tier security standard for HSM devices

CMTA Digital Assets Custody Standard, ensuring safe custody procedures and technology security

The globally trusted standard for information security

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Why financial institutions trade with Taurus-PRIME

FINMA regulated securities firm

Banking-grade security: built on Taurus custody technology

Best execution algorithms, adaptive fees schedule

All securities types: equity, debt, funds. Corporate-actions ready

Secondary markets available with PRIME organized trading facility

Auctions, continuous trading, or OTC based on asset liquidity

API-first design. FIX, REST, Websocket, voice / chat available

Trade execution: RFQ, Limit, TWAP

Quotes in fiat (USD, EUR, CHF) and stablecoins (USDC, USDT, EUROC)

Trade from your cold storage with Taurus-NETWORK

With your own existing trading solution and OMS

Fully API-ready

Standard for risk assurance and internal controls

Top-tier security standard for HSM devices

CMTA Digital Assets Custody Standard, ensuring safe custody procedures and technology security

The globally trusted standard for information security

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending

Simplify on-chain and fiat settlement operations while automating compliance tasks