custody platform

Hot, warm, and cold storage for digital assets:

custody, staking, and asset servicing

Hot, warm, and cold storage for digital assets:

custody, staking, and asset servicing

Why financial institutions select Taurus-PROTECT custody

HSM signature mechanisms. State-of-the-art MPC algorithms

Hot, warm, cold storage. Full private keys sovereignty

ISAE 3402 Type II, ISO 27001, FIPS 140-2 Level 3 HSM

No limit on workflows: wallets, addresses, smart contracts

Orchestration rules verified inside Trusted Execution Environment

Multiple roles, audit trails, and risk monitoring

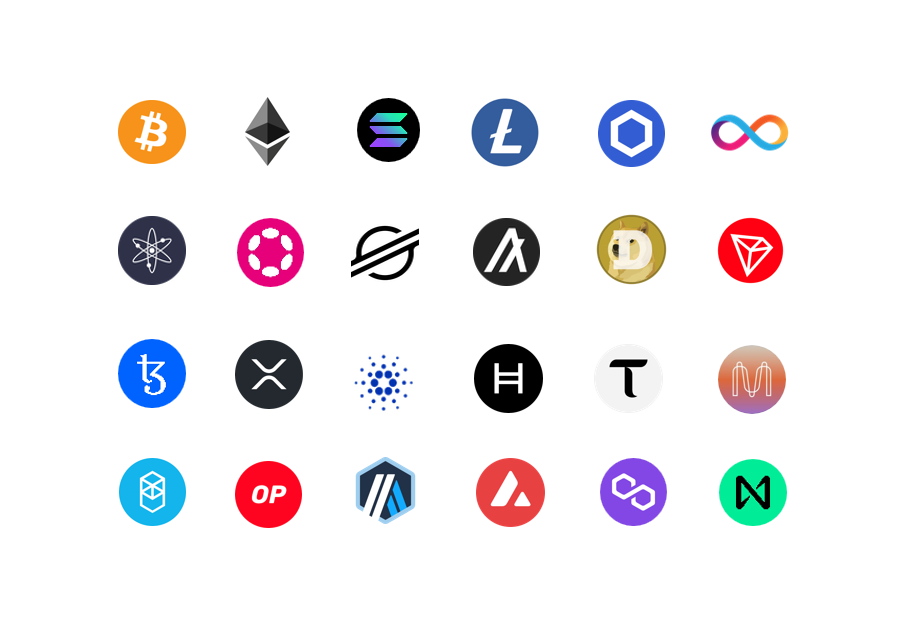

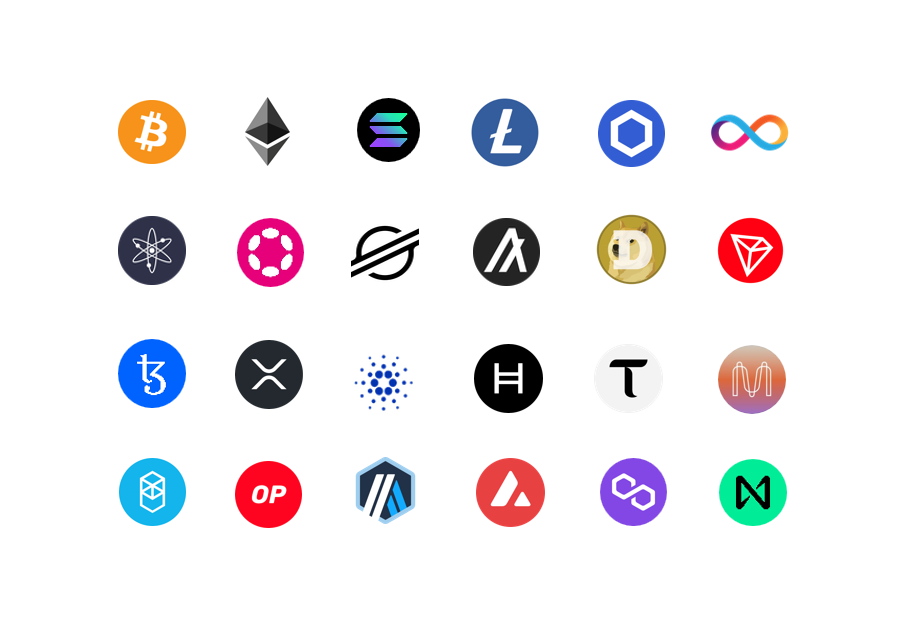

Cryptocurrencies, including staking

Tokenized securities, including asset servicing automation

Digital currencies: public and permissioned blockchains

With Taurus-CAPITAL tokenization natively integrated

With our proprietary nodes and indexing infrastructure, 99% SLA

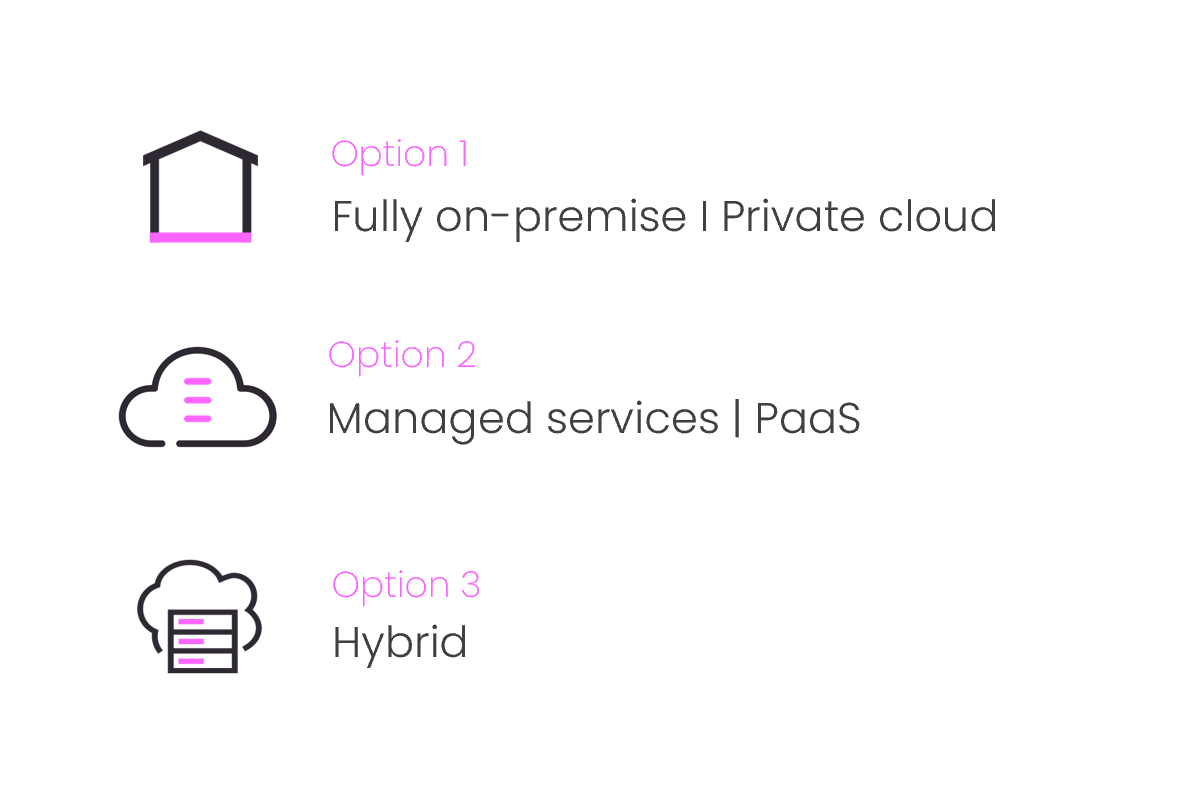

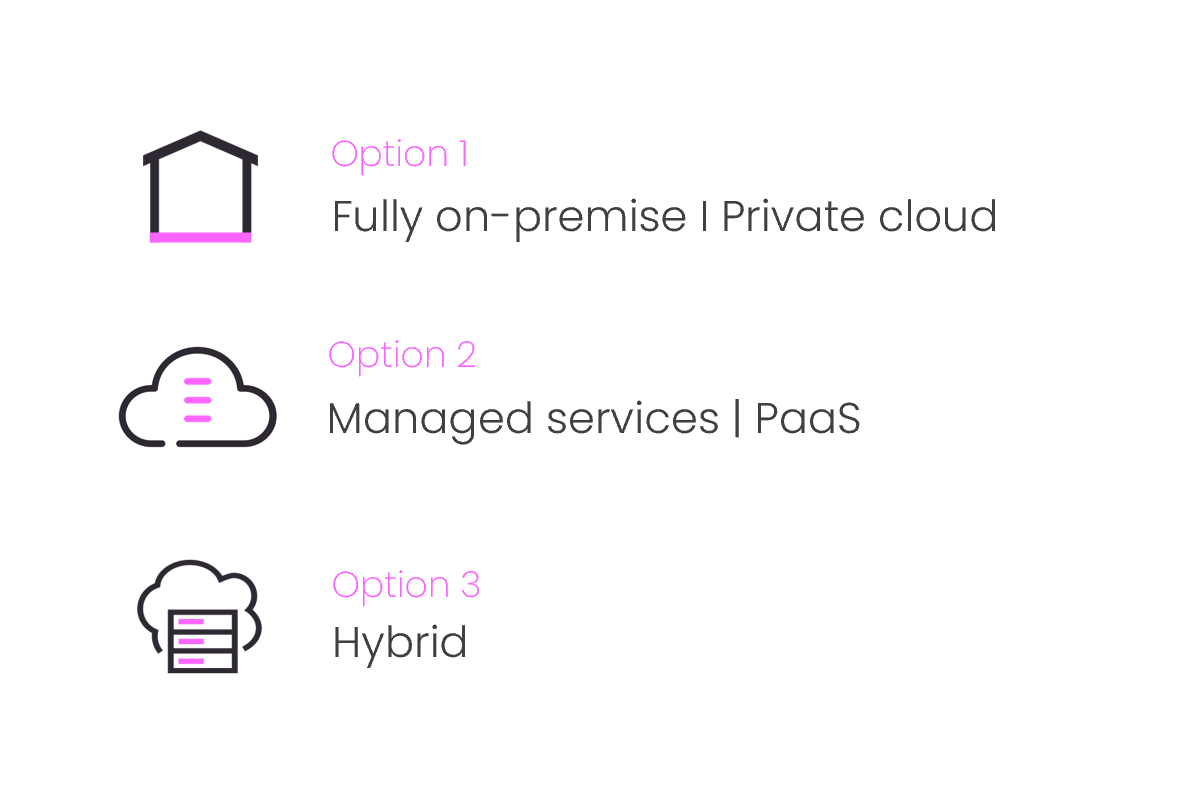

Flexible deployment: managed services, on-premise, or hybrid

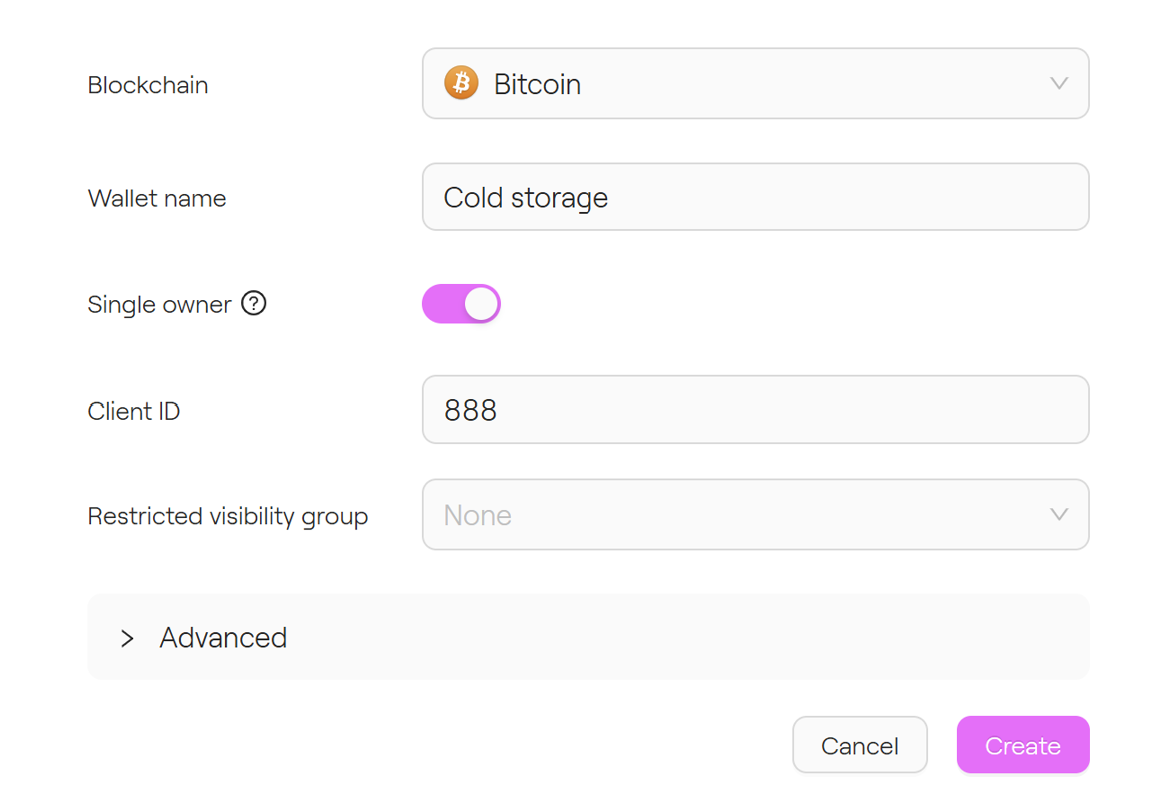

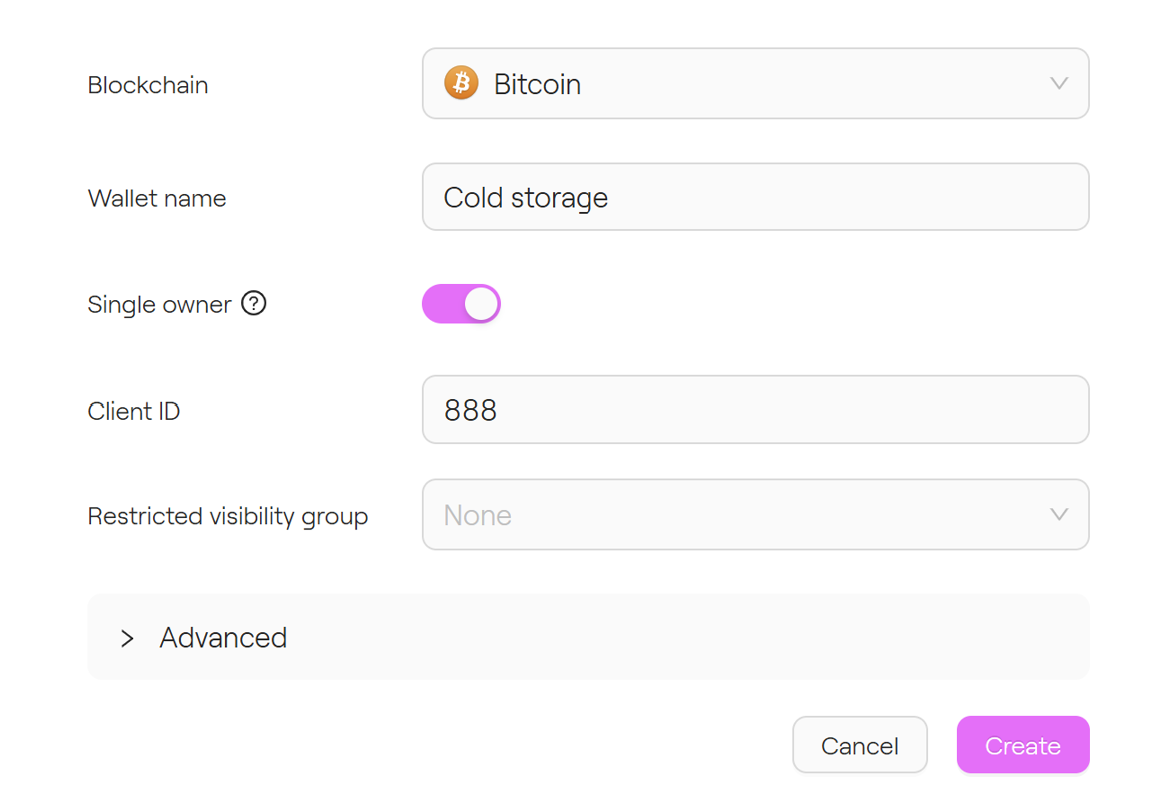

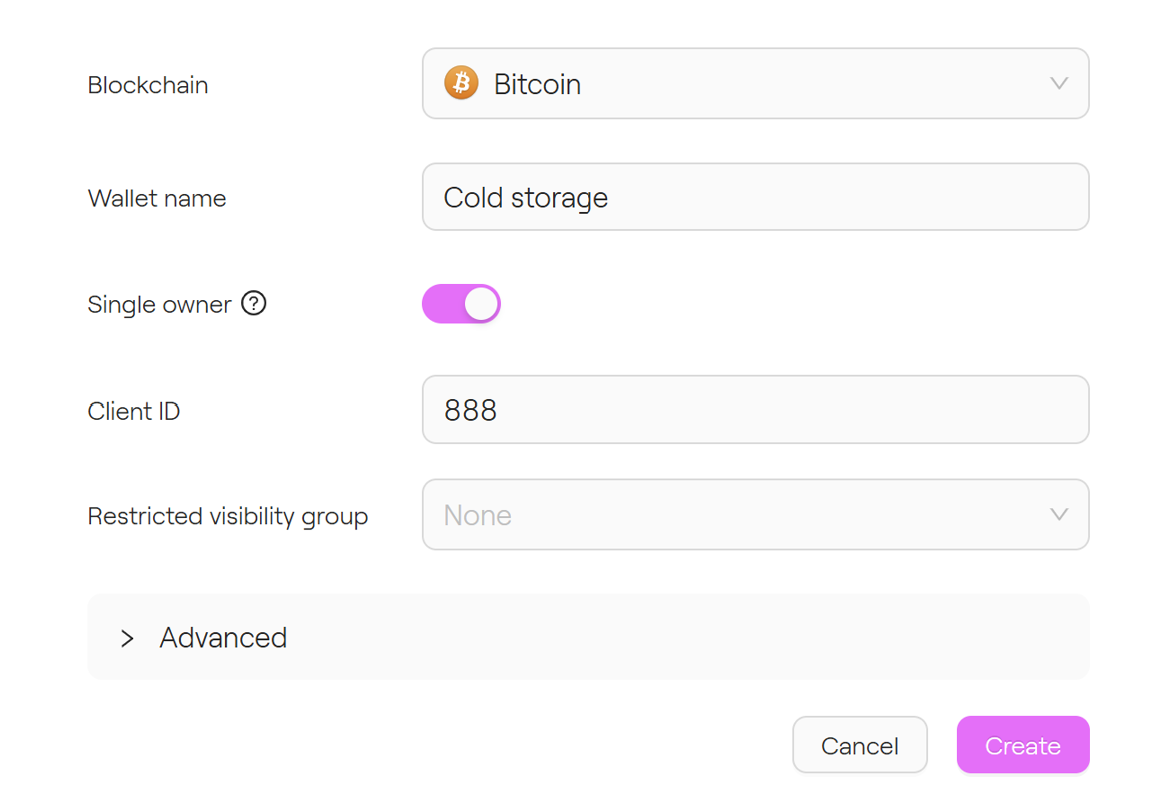

Manage high volumes of wallets, transactions and assets seamlessly:

Set-up in seggregated wallets or omnibus depending on your business and regulatory requirements

Multi-tenant architecture to manage several booking centers

Automation-ready wallet behavior for batch validation

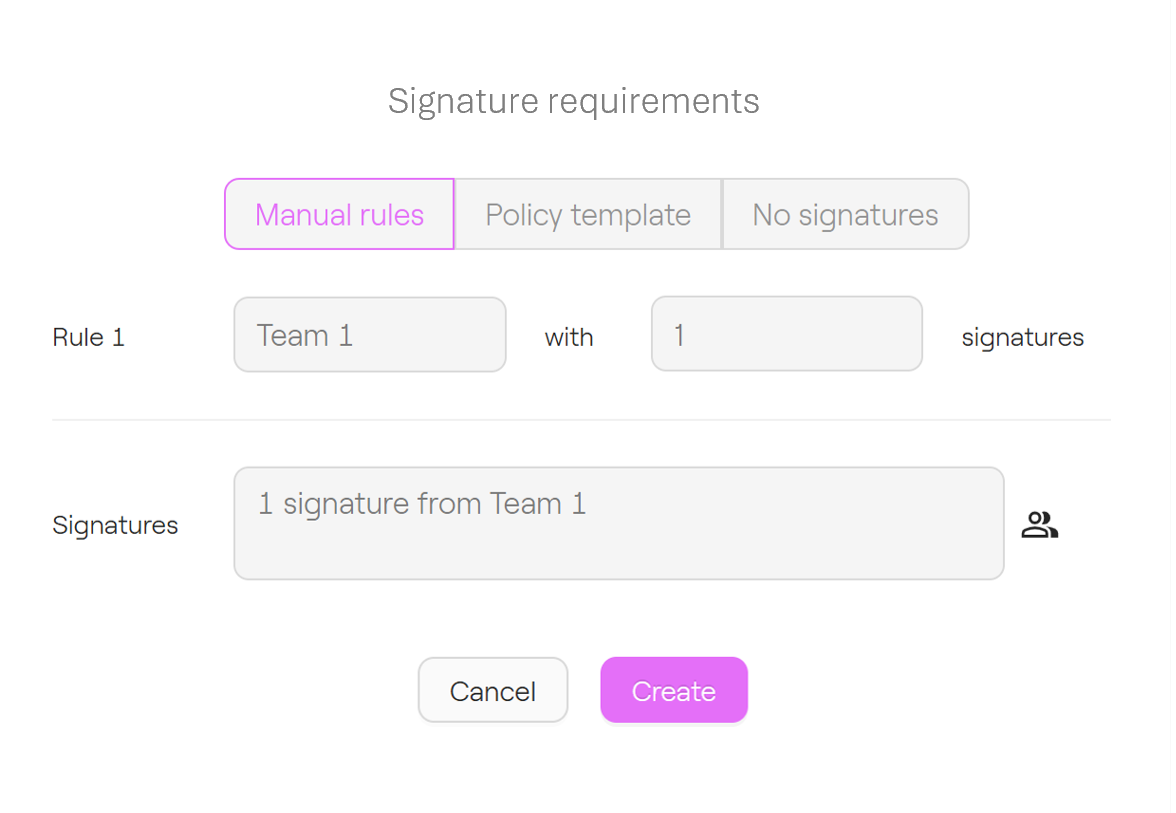

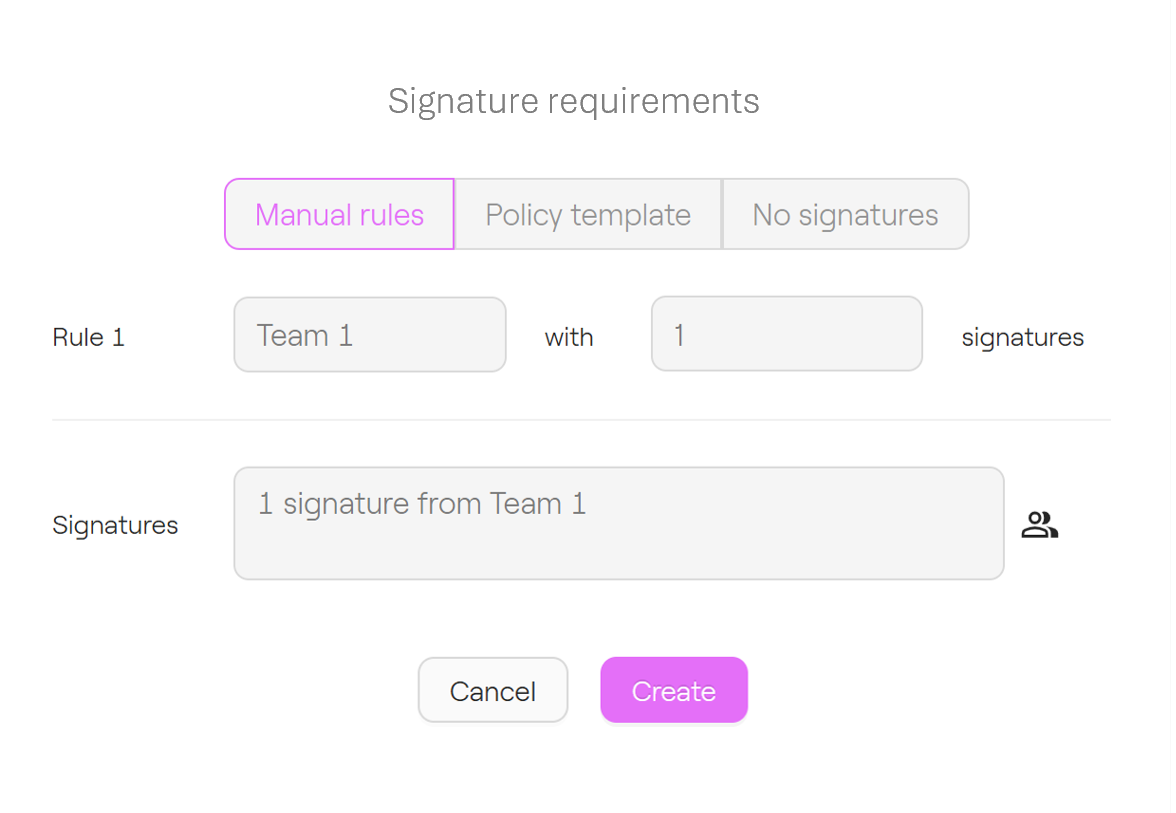

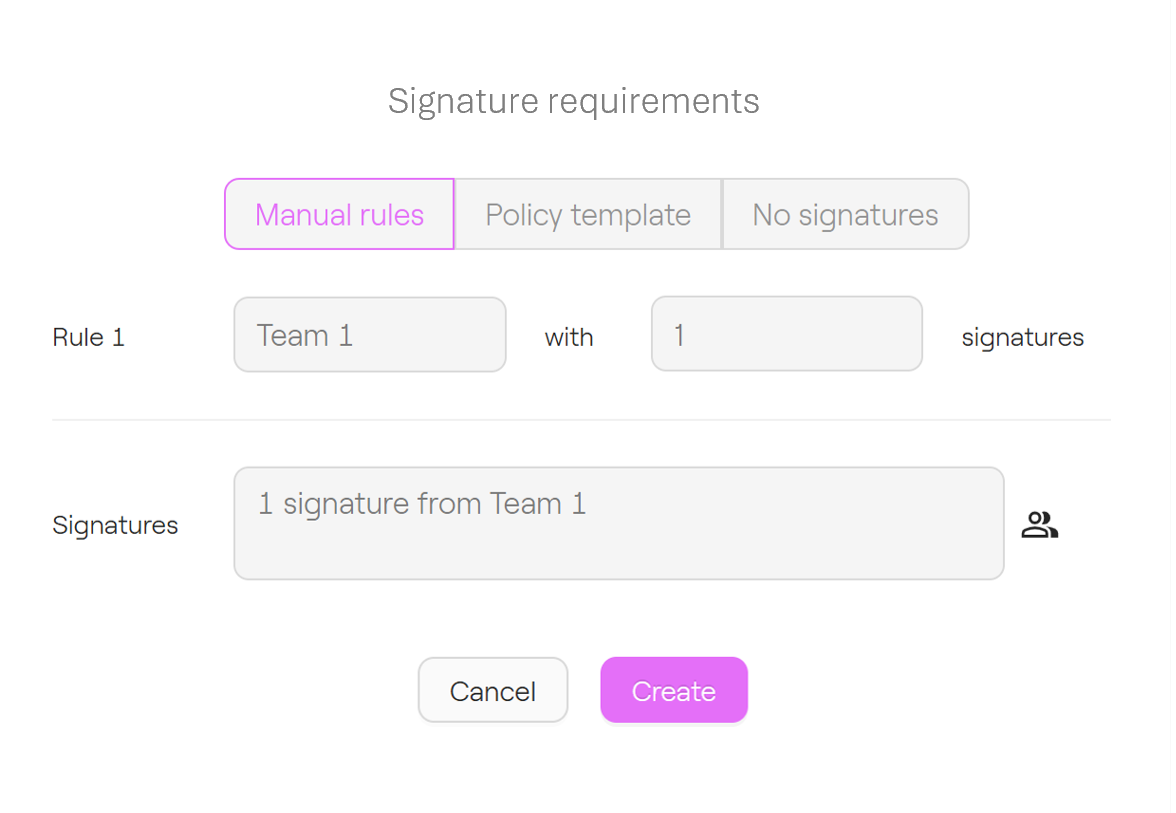

Mirror your target operating model with granular governance rules:

Wallets, addresses, transactions

Smart contracts, down to the most granular functions

Roles and user management: create, suspend, delete

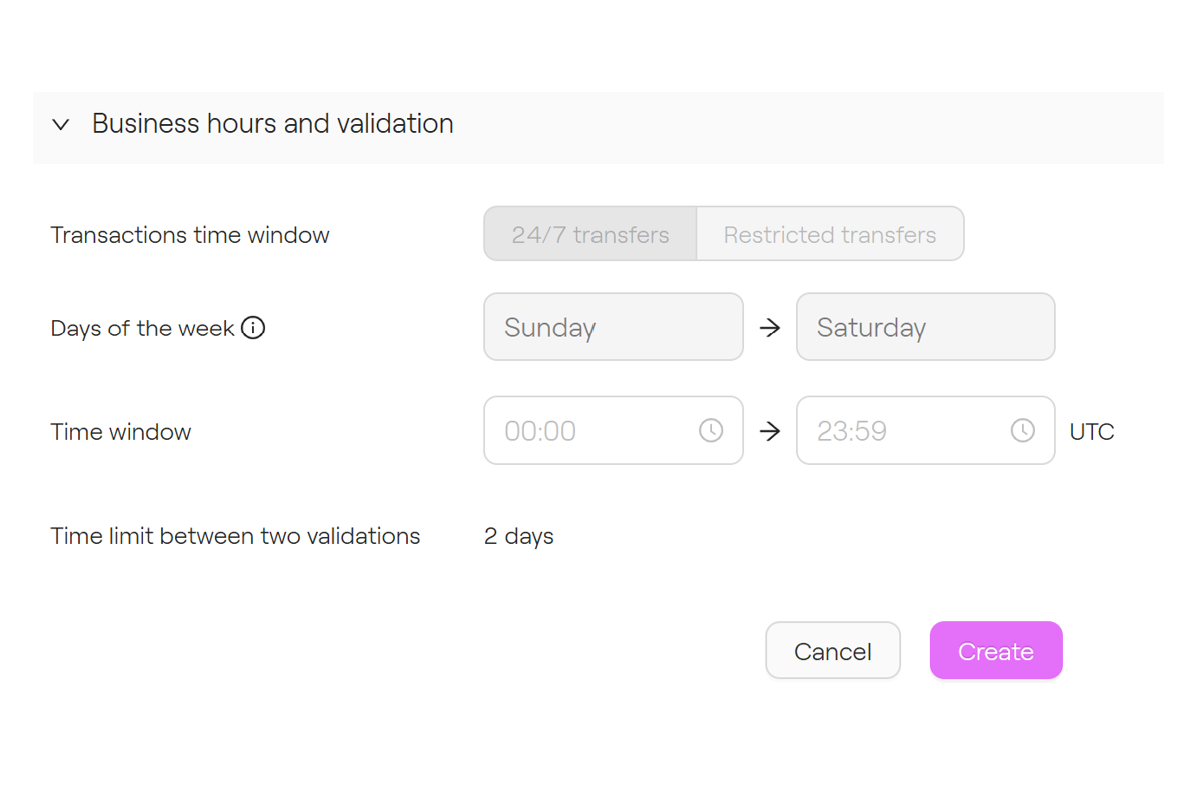

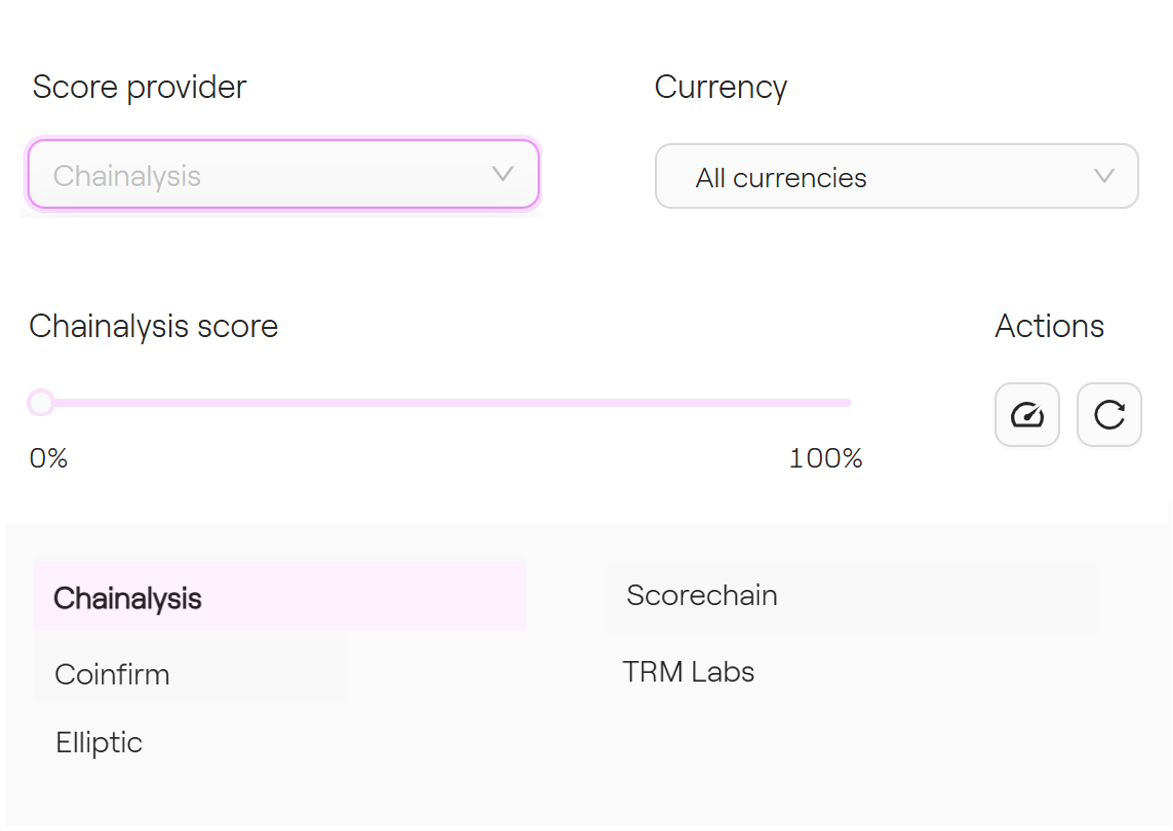

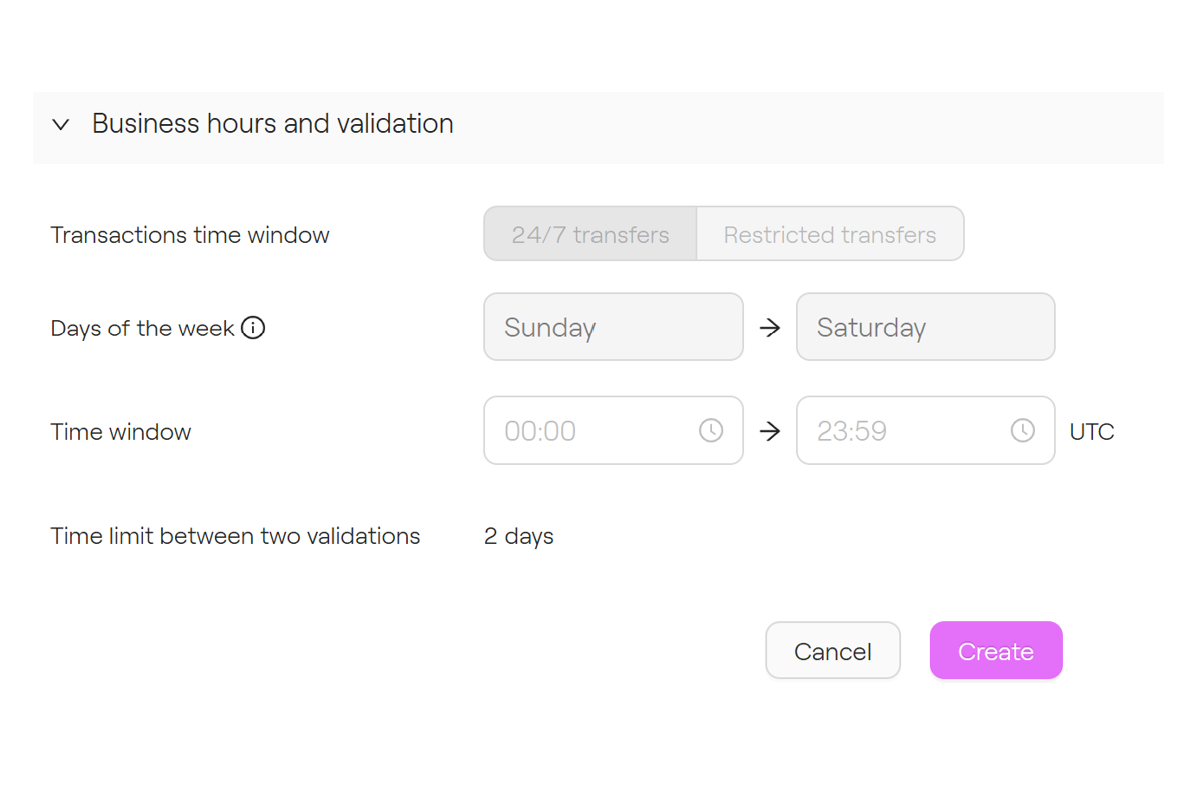

Secure blockchain interactions with flexible risk controls and policies:

Rate limiting and whitelisting for added security in transfers

Customizable alerts to detect potential risks in real time

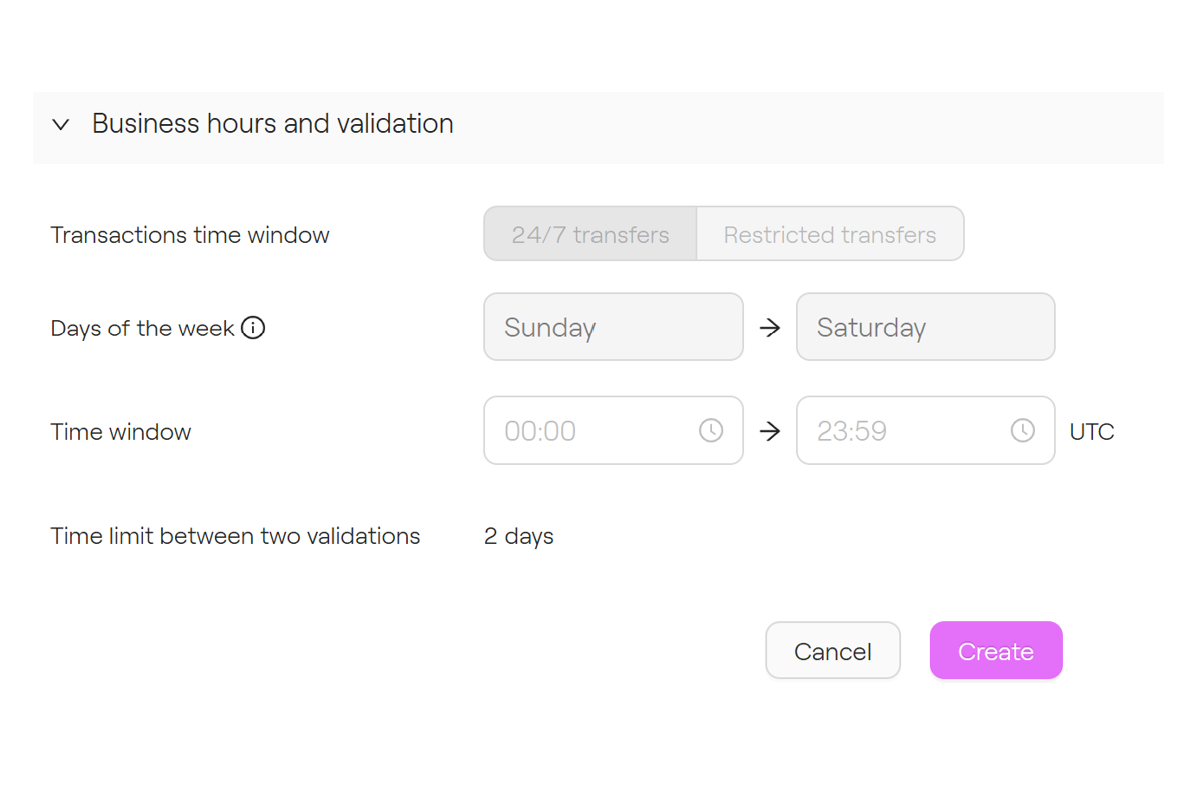

Business days and hours for validation

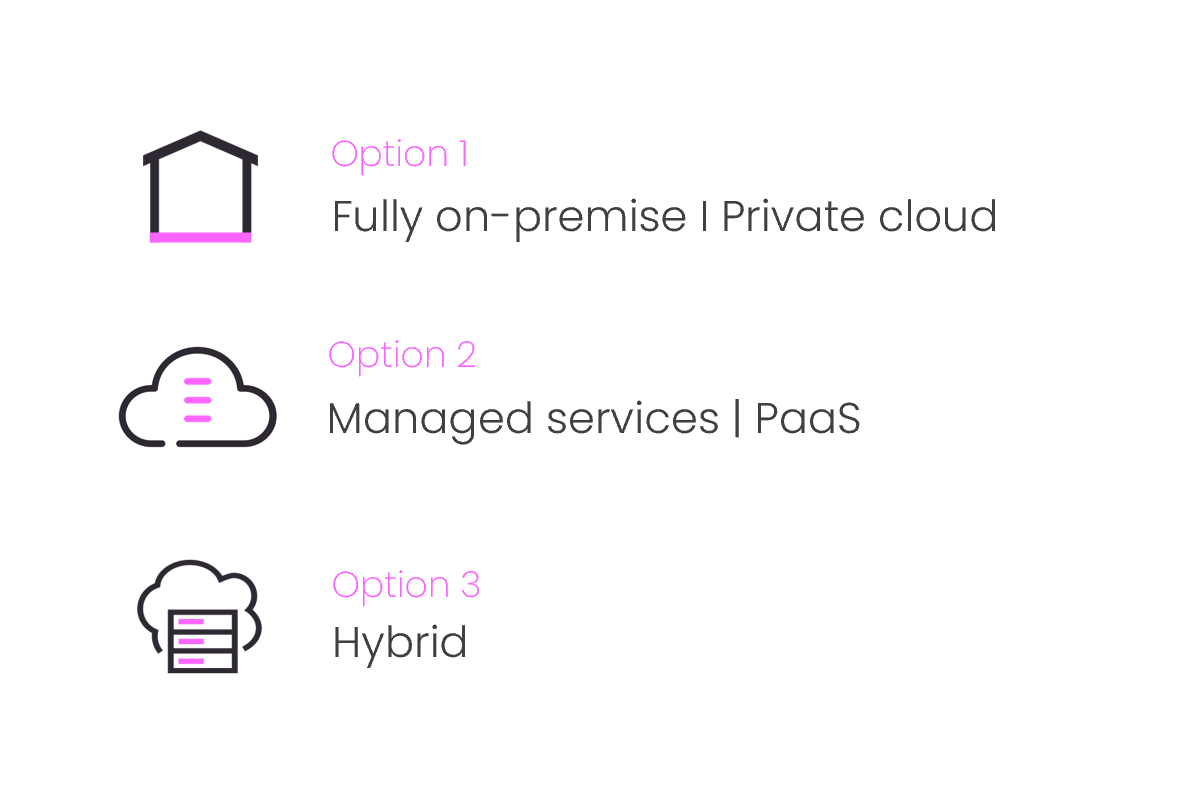

Meet your business, technical, and regulatory needs with a fully flexible deployment model:

On-premise: deploy Taurus platform within your infrastructure

Managed services: leave the full hosting to Taurus, keep control of your private keys

Hybrid: keep the most sensitive items and leave the rest to Taurus

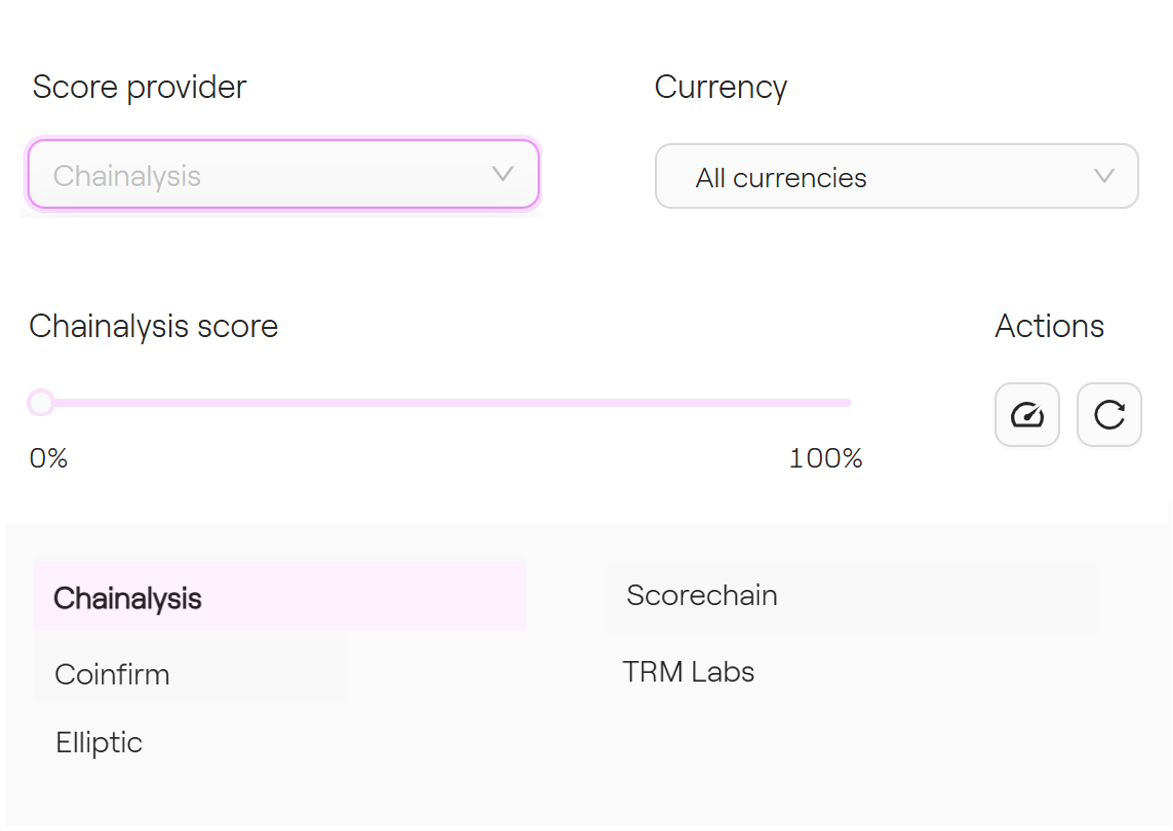

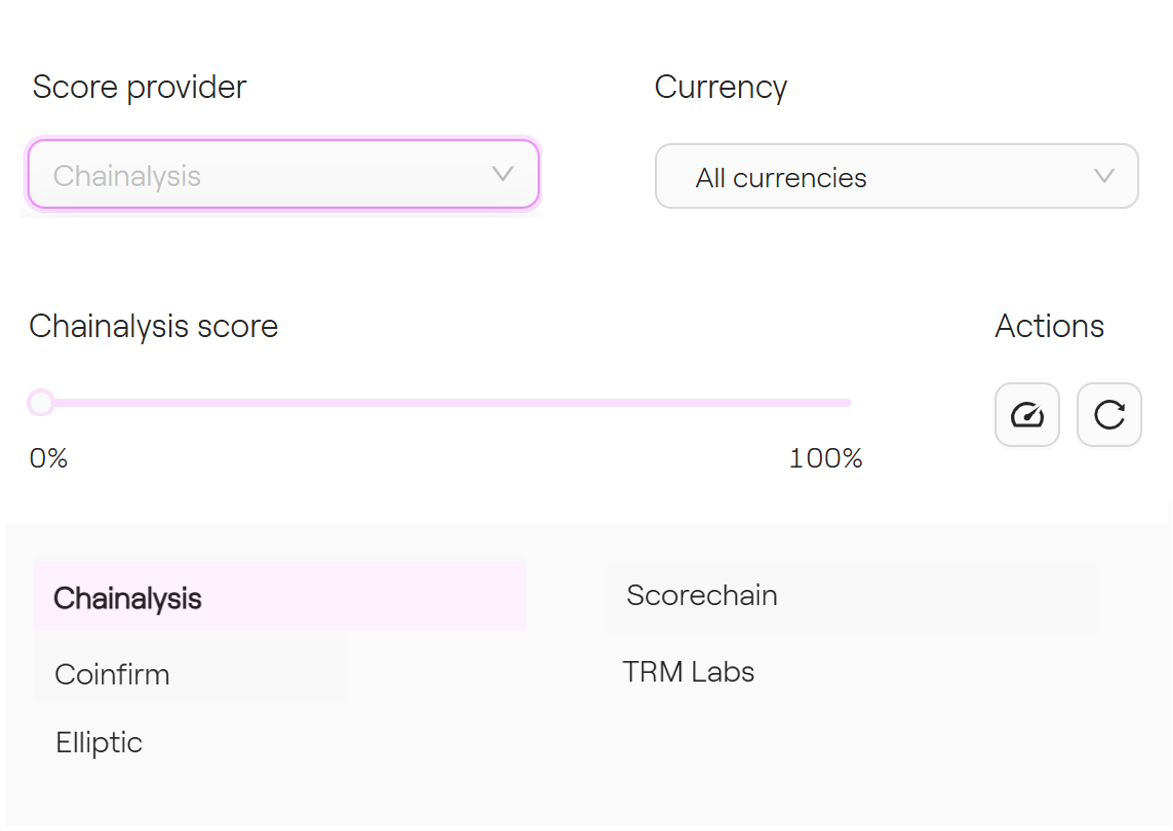

Streamline integration of compliance tools with native integration

Streamline integration of compliance tools with native integration

Travel Rule providers, including TRUST

Proprietary nodes and indexing infrastructure for public and permissioned blockchains coverage:

More than nodes: indexers, reliable broadcasting, fraud detection, replay attack protections

Easy to use: pre-integrated with Taurus-PROTECT

Third-party quality assurance: ISAE3402 Type II by Deloitte

Integrate seamlessly with core-banking, cloud providers, OMS, exchanges, staking, and data providers

10+ core banking integrations, pre-built connectors with Temenos

15+ exchanges and liquidity providers

Partnerships in place with key institutional players

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Hot, warm, and cold storage for digital assets:

custody, staking,and asset servicing

Why financial institutions select Taurus-PROTECT custody

HSM signature mechanisms. State-of-the-art MPC algorithms.

Hot, warm, cold storage. Full private keys sovereignty.

ISAE 3402 Type II, ISO 27001, FIPS 140-2 Level 3 HSM

No limit on workflows: wallets, addresses, smart contracts

Orchestration rules verified inside Trusted Execution Environment

Multiple roles, audit trails, and risk monitoring

Cryptocurrencies, including staking

Tokenized securities, including asset servicing automation

Digital currencies: public and permissioned blockchains

With Taurus-CAPITAL tokenization, natively integrated

With our proprietary nodes and indexing infrastructure, 99% SLA

Flexible deployment: managed services, on-premise, or hybrid

Manage high volumes of wallets, transactions and assets seamlessly:

Set-up in seggregated wallets or omnibus depending on your business and regulatory requirements

Multi-tenant architecture to manage several booking centers

Automation-ready wallet behavior for batch validation

Mirror your target operating model with granular governance rules:

Wallets, addresses, transactions

Smart contracts, down to the most granular functions

Roles and user management: create, suspend, delete

Secure blockchain interactions with flexible risk controls and policies:

Rate limiting and whitelisting for added security in transfers

Customizable alerts to detect potential risks in real time

Business days and hours for validation

Meet your business, technical, and regulatory needs with a fully flexible deployment model:

On-premise: deploy Taurus platform within your infrastructure

Managed services: leave the full hosting to Taurus, keep control of your private keys

Hybrid: keep the most sensitive items and leave the rest to Taurus

Streamline integration of compliance tools with native integration

Streamline integration of compliance tools with native integration

Travel Rule providers, including TRUST

Proprietary nodes and indexing infrastructure for public and permissioned blockchains coverage:

More than nodes: indexers, reliable broadcasting, fraud detection, replay attack protections

Easy to use: pre-integrated with Taurus-PROTECT

Third-party quality assurance: ISAE3402 Type II by Deloitte

Integrate seamlessly with core-banking, cloud providers, OMS, exchanges, staking, and data providers

10+ core banking integrations, pre-built connectors with Temenos

15+ exchanges and liquidity providers

Partnerships in place with key institutional players

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Why financial institutions select Taurus-PROTECT custody

HSM signature mechanisms. State-of-the-art MPC algorithms.

Hot, warm, cold storage. Full private keys sovereignty.

ISAE 3402 Type II, ISO 27001, FIPS 140-2 Level 3 HSM

No limit on workflows: wallets, addresses, smart contracts

Orchestration rules verified inside Trusted Execution Environment

Multiple roles, audit trails, and risk monitoring

Cryptocurrencies, including staking

Tokenized securities, including asset servicing automation

Digital currencies: public and permissioned blockchains

With Taurus-CAPITAL tokenization natively integrated

With our proprietary nodes and indexing infrastructure, 99% SLA

Flexible deployment: managed services, on-premise, or hybrid

Manage high volumes of wallets, transactions and assets seamlessly:

Mirror your target operating model with granular governance rules:

Secure blockchain interactions with flexible risk controls and policies:

Meet your business, technical, and regulatory needs with a fully flexible deployment model:

Streamline integration of compliance tools with native integration

Proprietary nodes and indexing infrastructure for public and permissioned blockchains coverage:

Integrate seamlessly with core-banking, cloud providers, OMS, exchanges, staking, and data providers

Experience is a priority for us

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Why financial institutions select Taurus-PROTECT custody

HSM signature mechanisms. State-of-the-art MPC algorithms.

Hot, warm, cold storage. Full private keys sovereignty.

ISAE 3402 Type II, ISO 27001, FIPS 140-2 Level 3 HSM

No limit on workflows: wallets, addresses, smart contracts

Orchestration rules verified inside Trusted Execution Environment

Multiple roles, audit trails, and risk monitoring

Cryptocurrencies, including staking

Tokenized securities, including asset servicing automation

Digital currencies: public and permissioned blockchains

With Taurus-CAPITAL tokenization, natively integrated

With our proprietary nodes and indexing infrastructure, 99% SLA

Flexible deployment: managed services, on-premise, or hybrid

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending

Simplify on-chain and fiat settlement operations while automating compliance tasks