tokenization platform

Issue and service tokenized assets with the widest blockchain and smart contract coverage.

Issue and service tokenized assets with the widest blockchain and smart contract coverage.

Why financial institutions select Taurus-CAPITAL tokenization

DLT securities: equity, debt, structured products, funds, real estate

Digital currencies: stablecoins, tokenized deposits, CBDCs

Collectibles

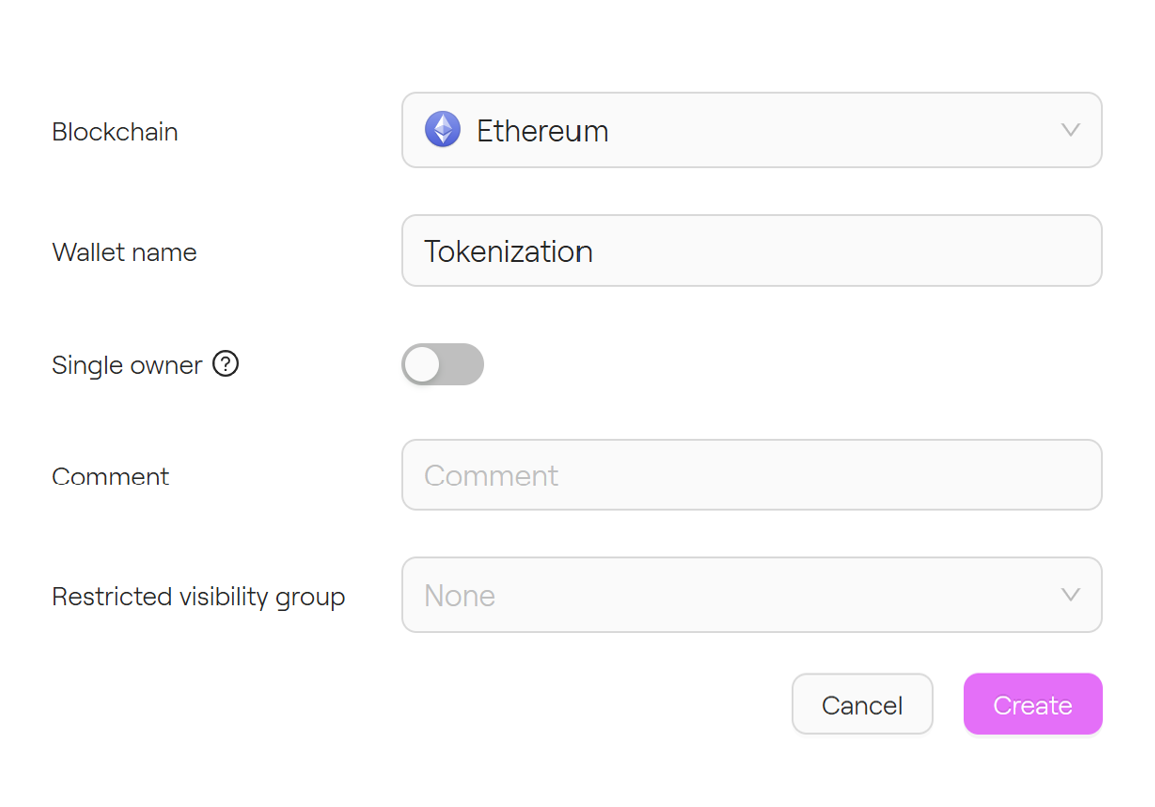

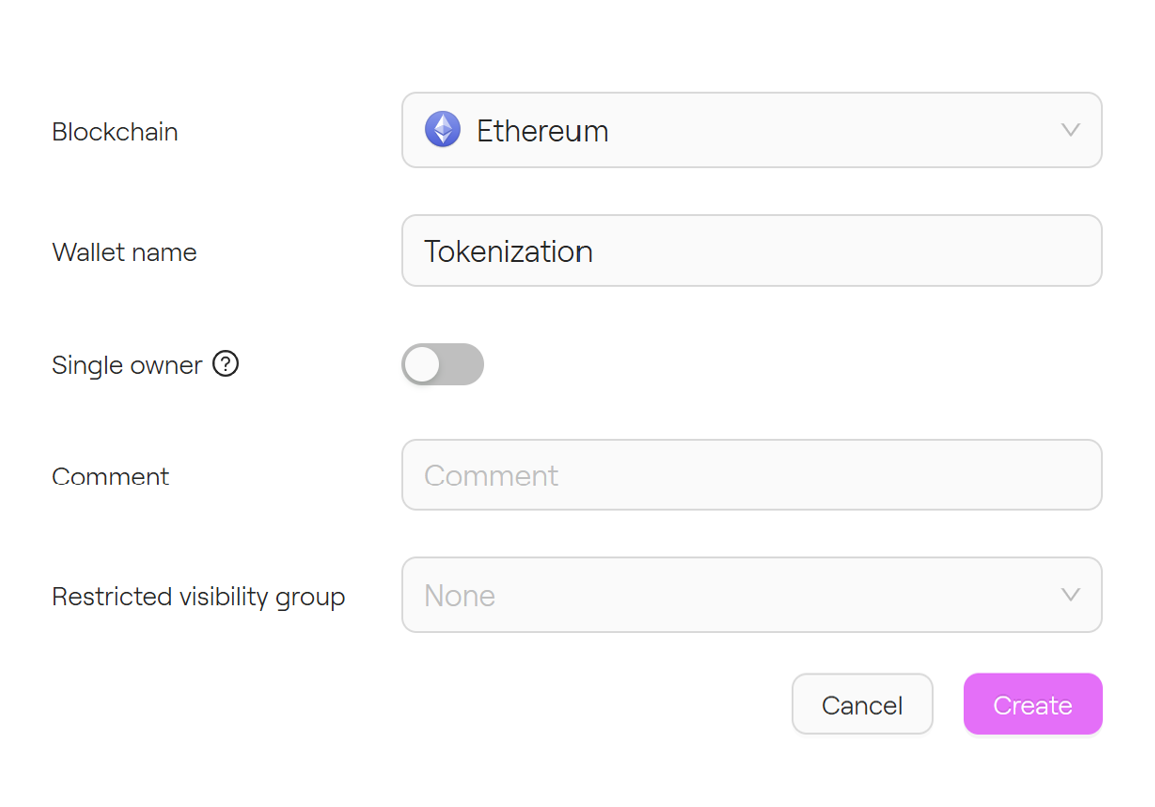

Issuance: deploy smart contracts securely

Lifecycle management: interact with any smart contract functions seamlessly

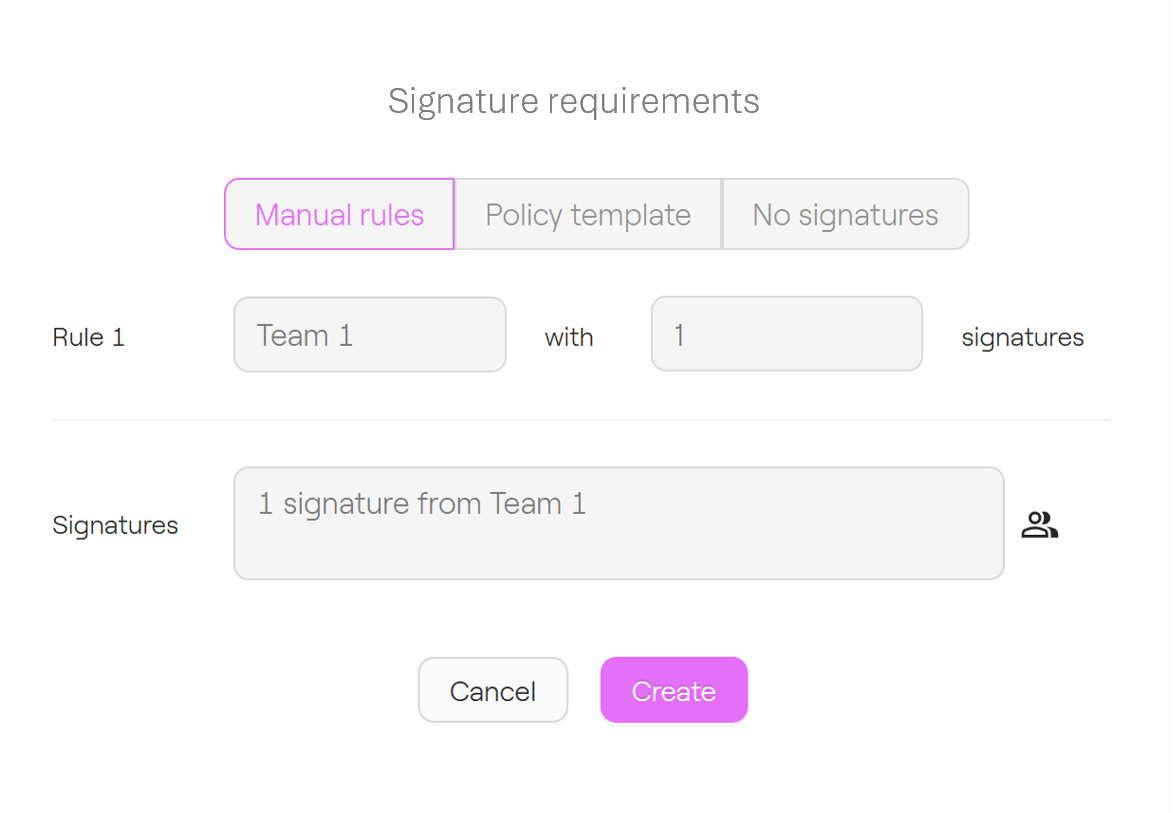

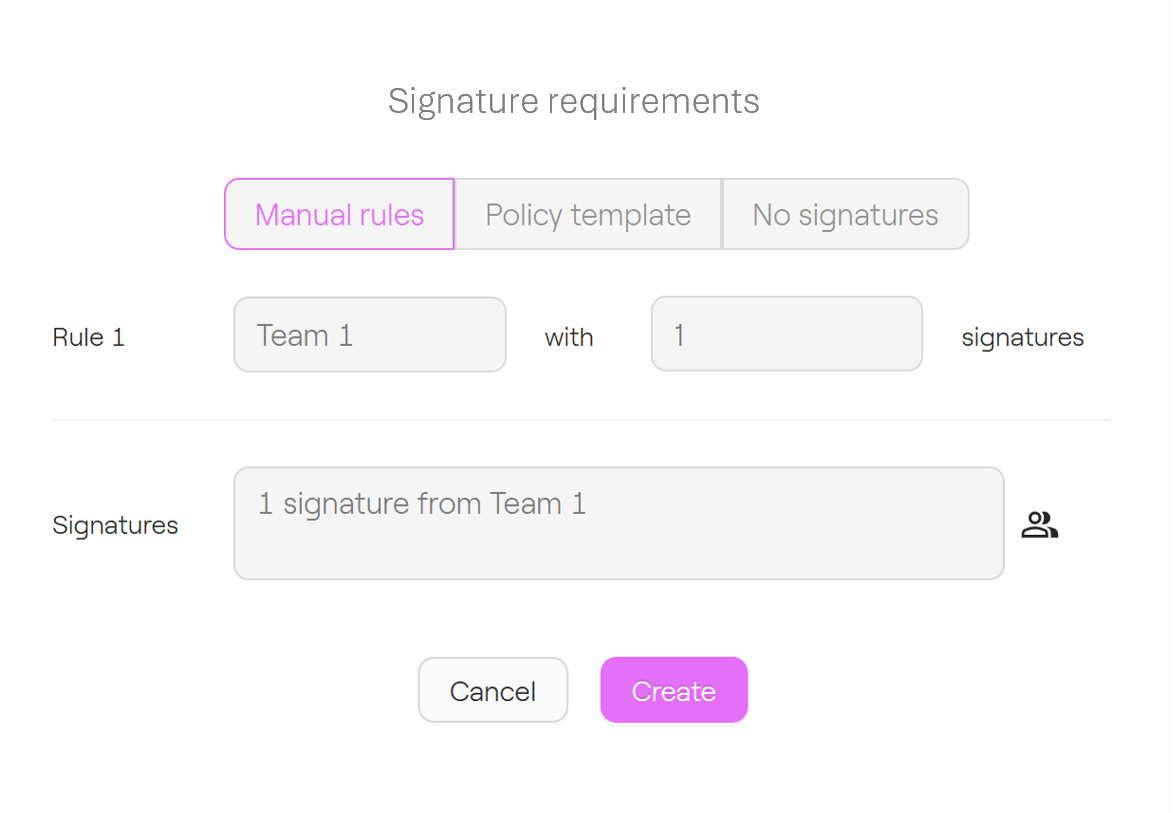

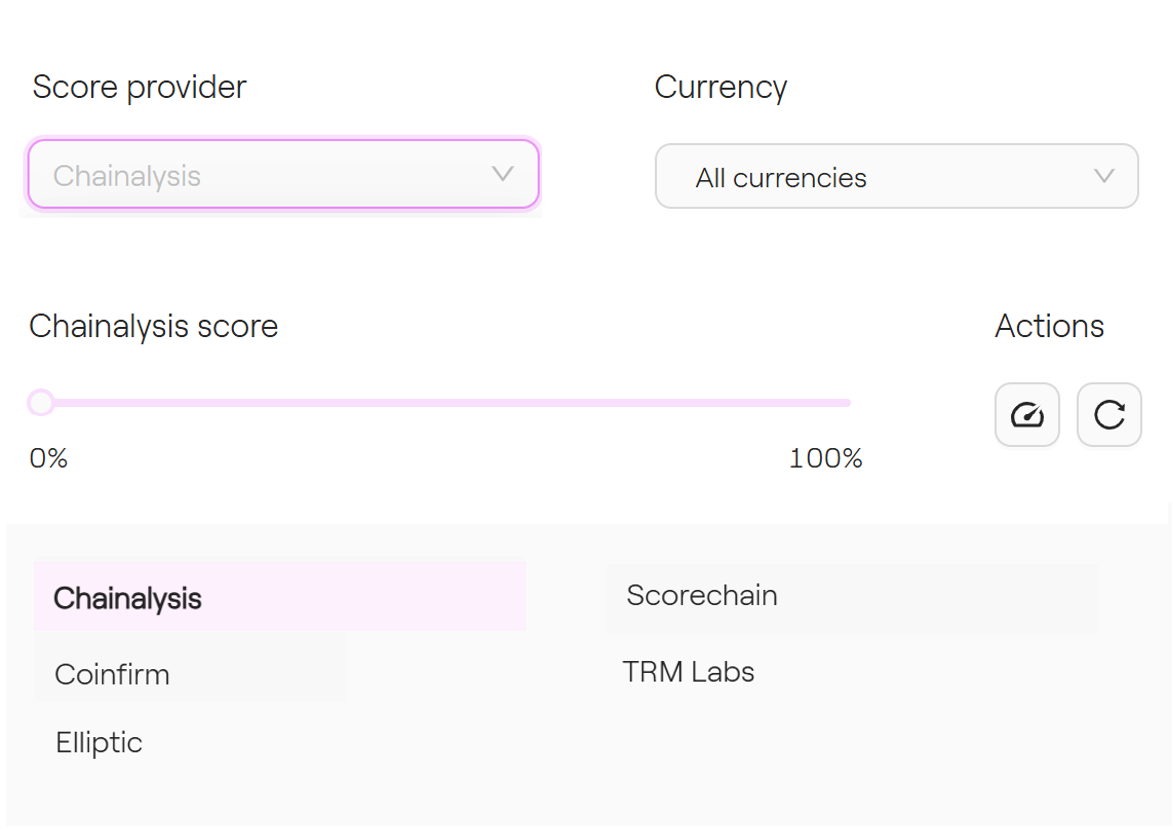

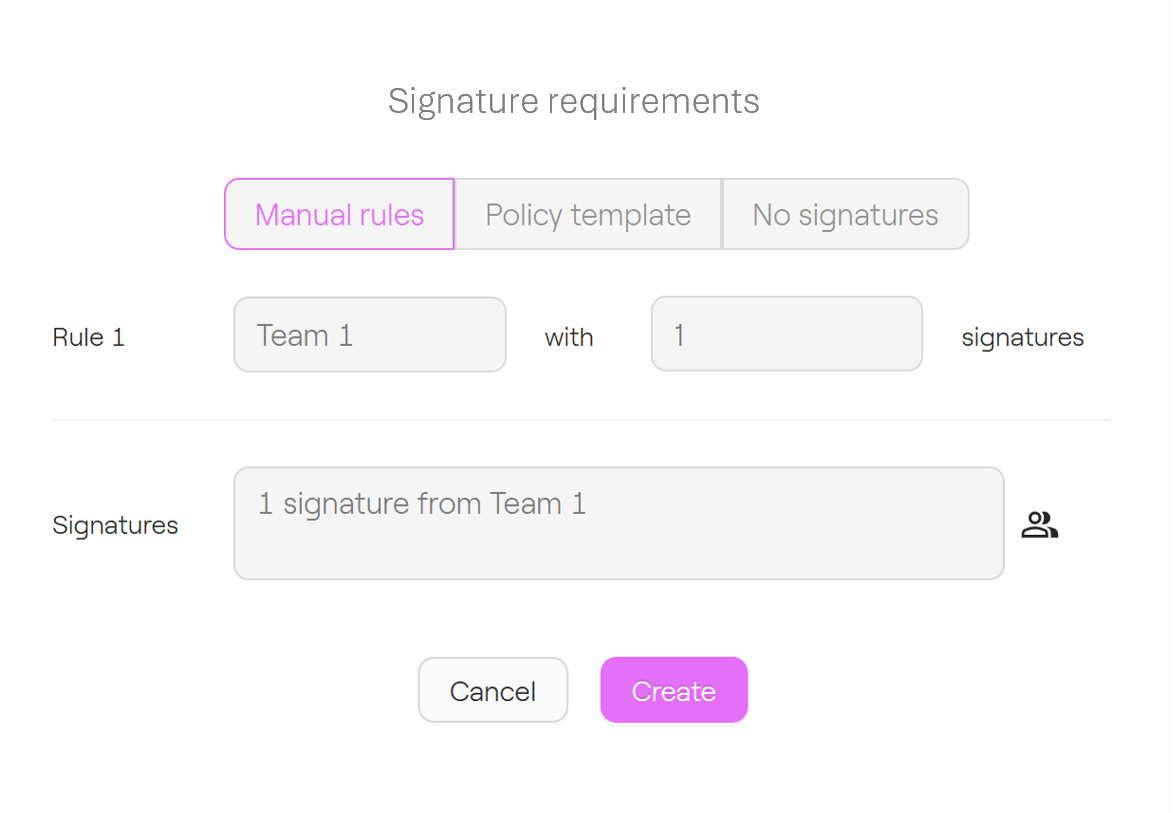

On-chain & off-chain governance rules

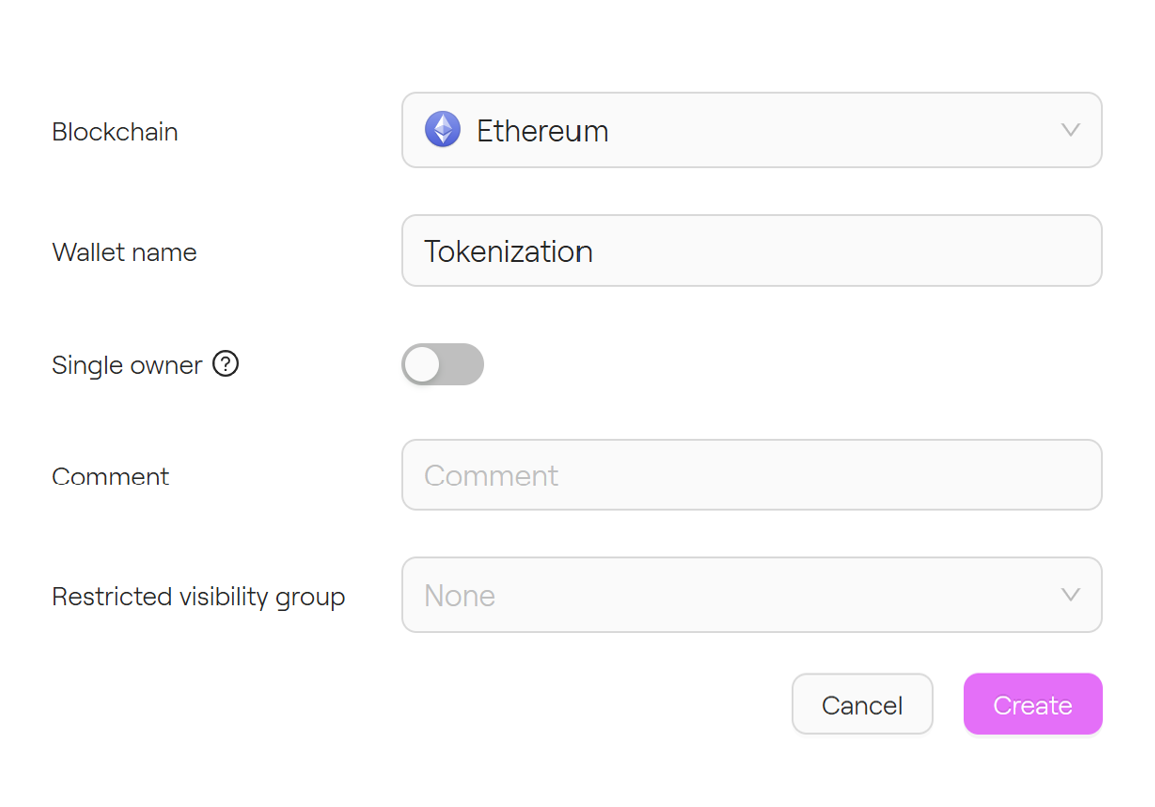

EVM protocols: Ethereum, Polygon, Optimism, Avalanche...

Non-EVM protocols: Stellar, Solana, ICP, Tezos...

Permissioned: Hyperledger BESU, Canton (soon), Quorum, etc...

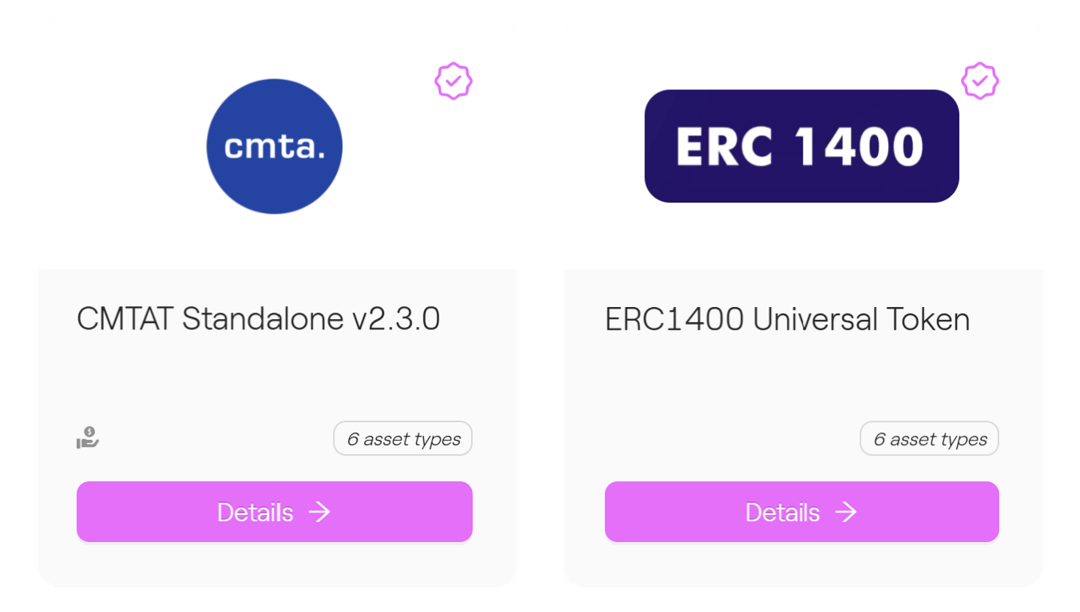

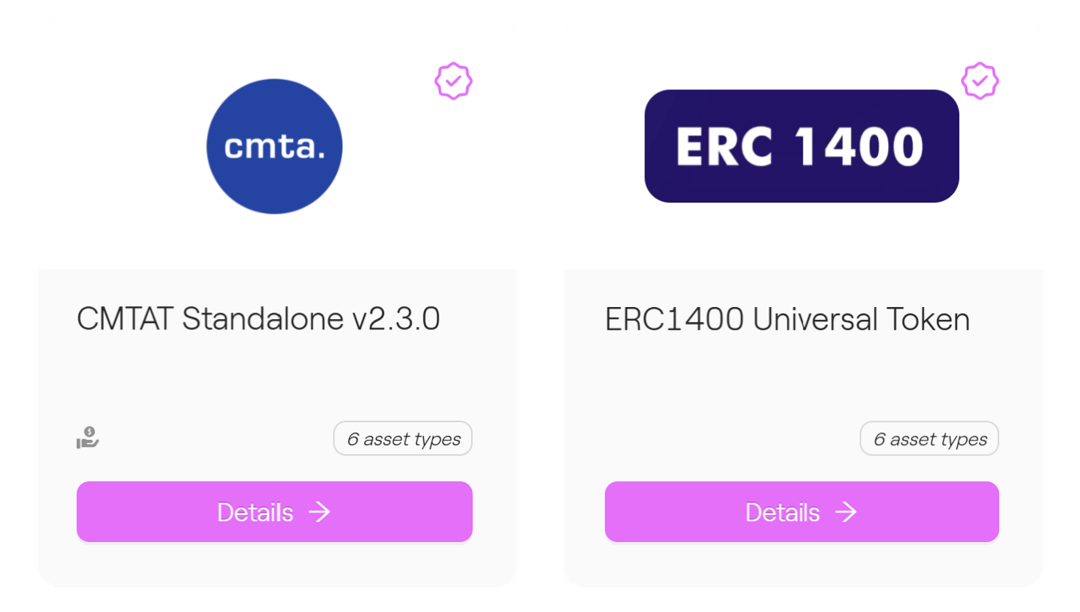

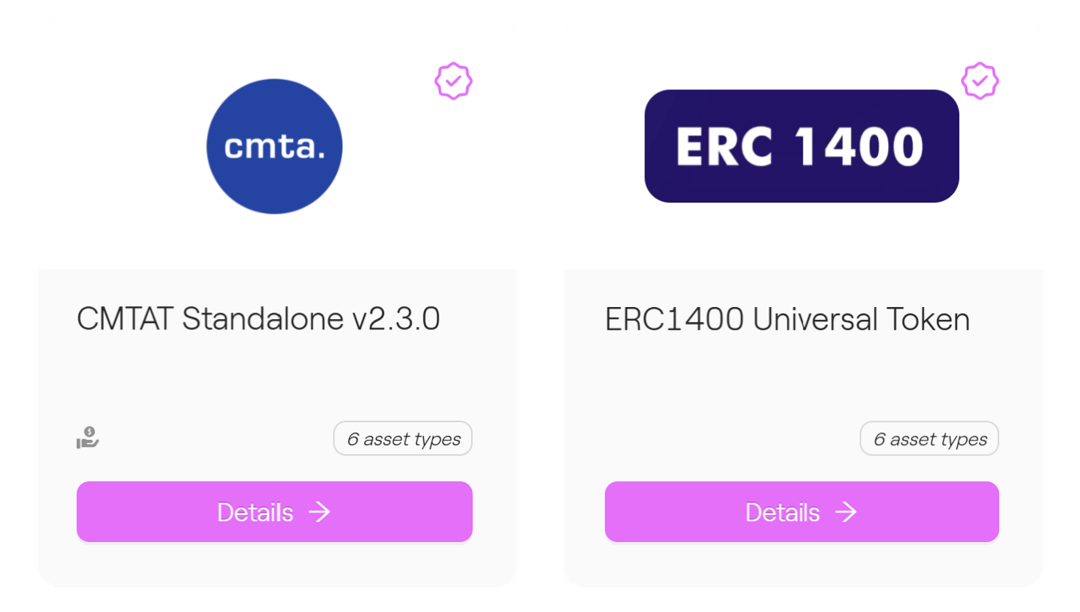

Library of templates (CMTAT, ERC3643, ERC1400, SPL...)

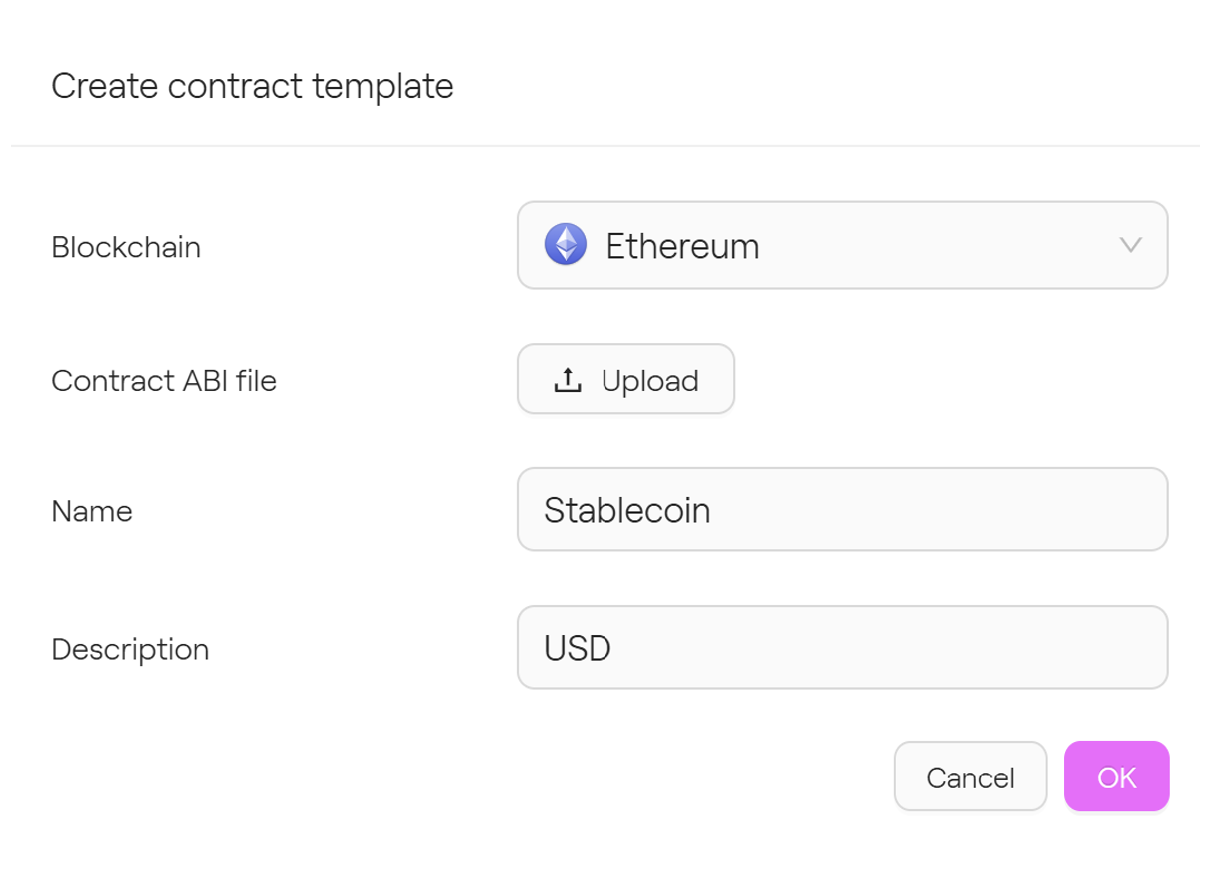

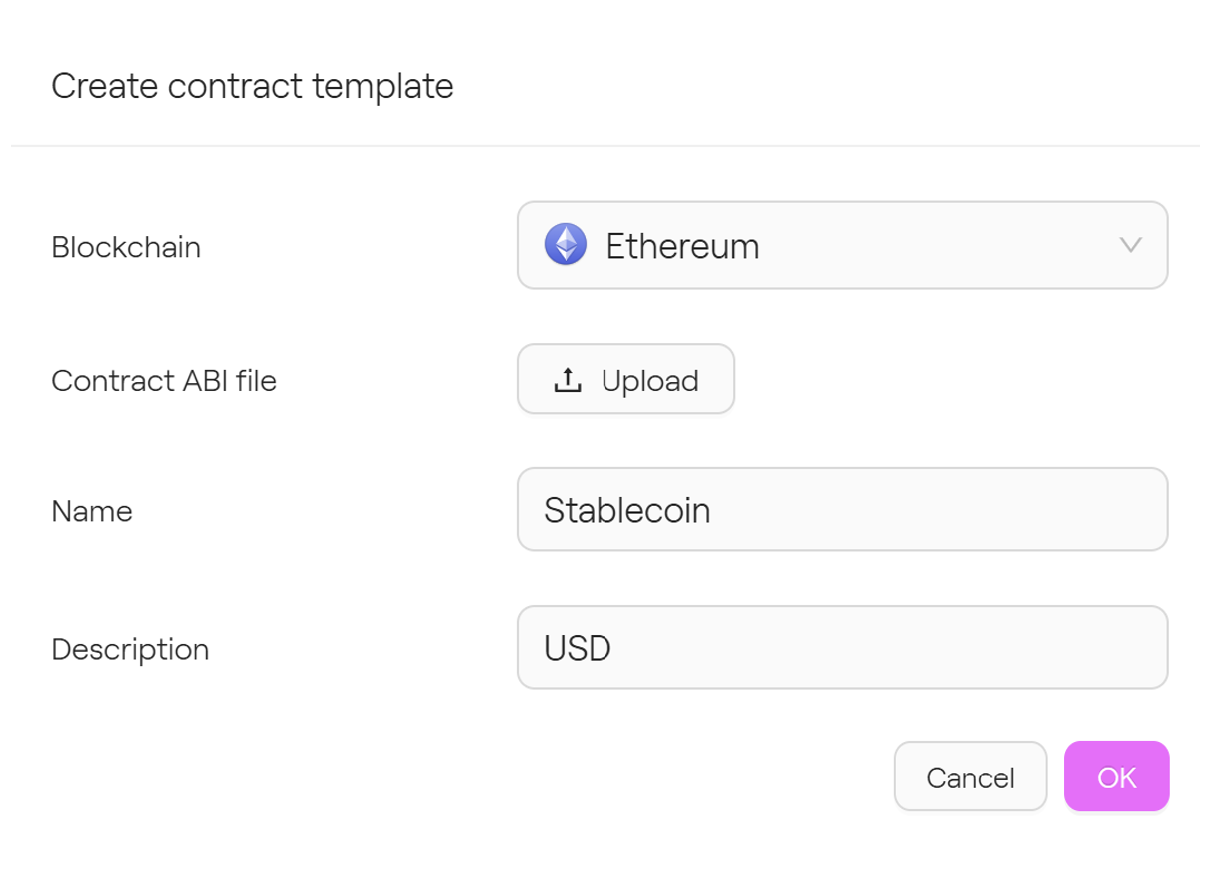

Home-made smart contracts: upload your own with no limit

Third-party issued smart contracts: interact with no limit

Pre-integrated with Taurus-PROTECT for secure asset servicing.

End-to-end asset servicing rules fully configurable

Zero integration cost and engineering.

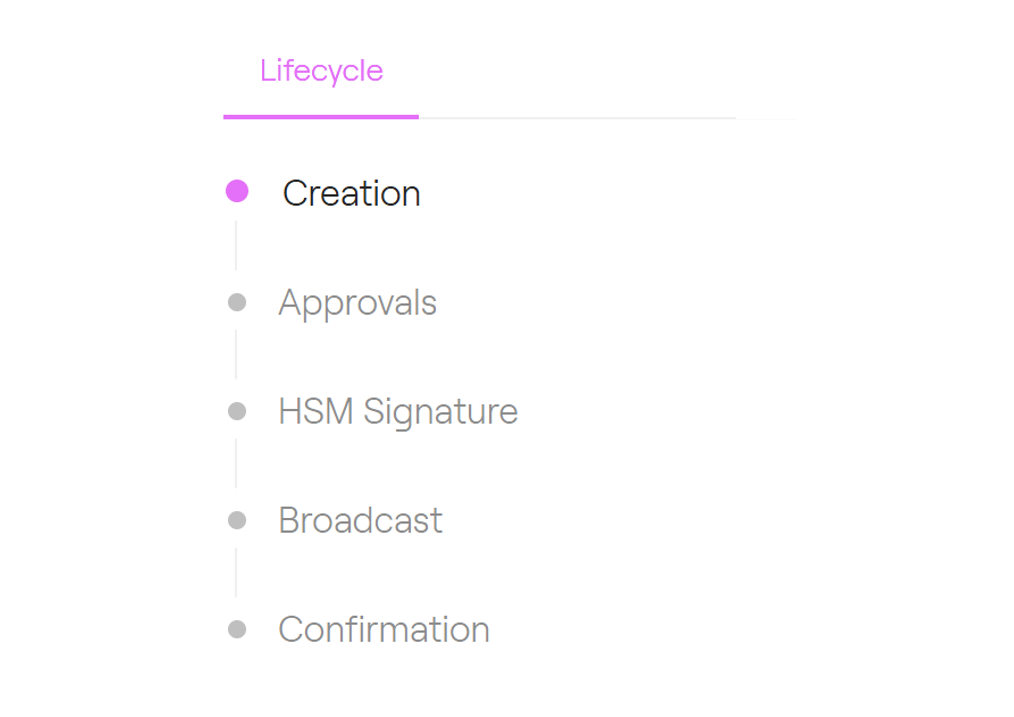

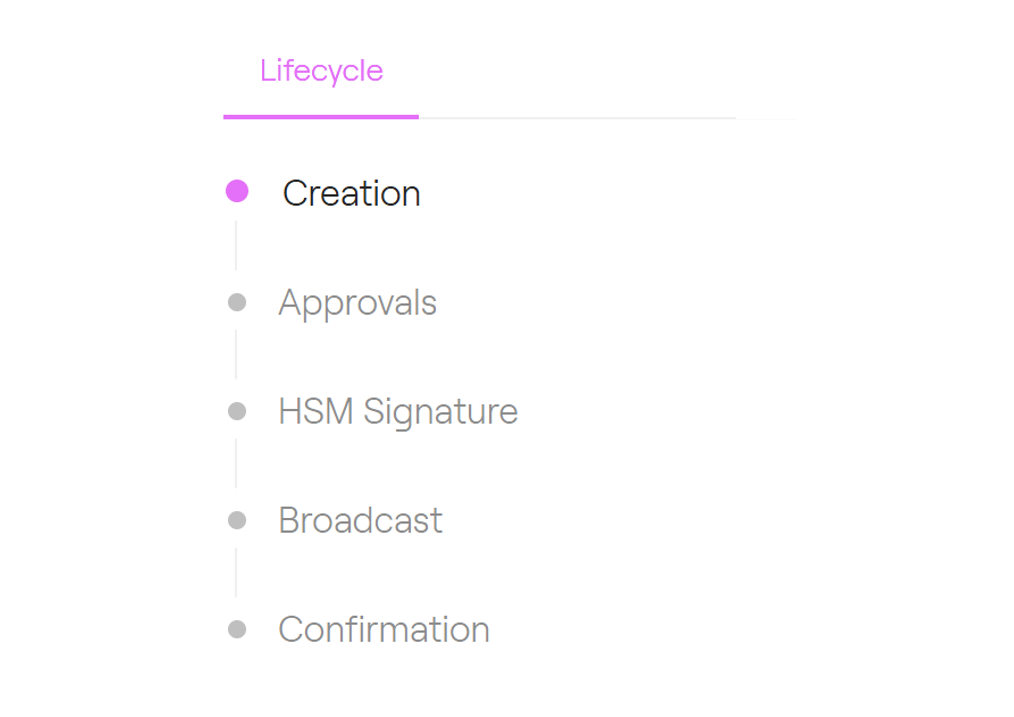

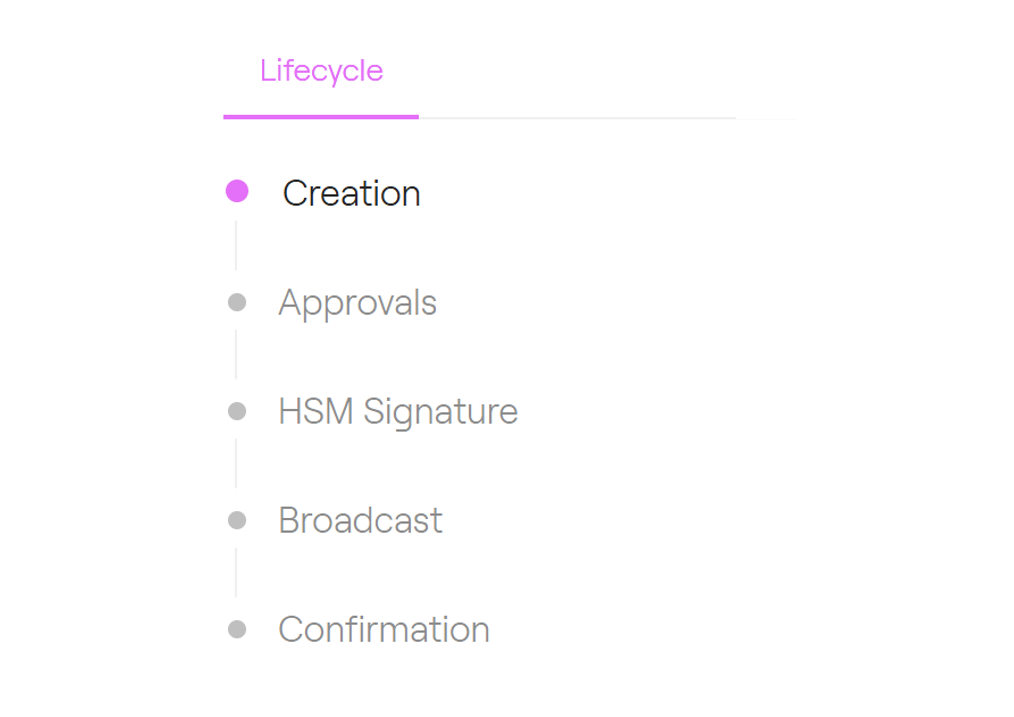

Highest security with smart contract deployment and functions calls processed in the HSM

Trust the highest security standards built for financial institutions.

Full audit trails for transparency

Advanced security: HSM, MPC, TSS ensure asset protection

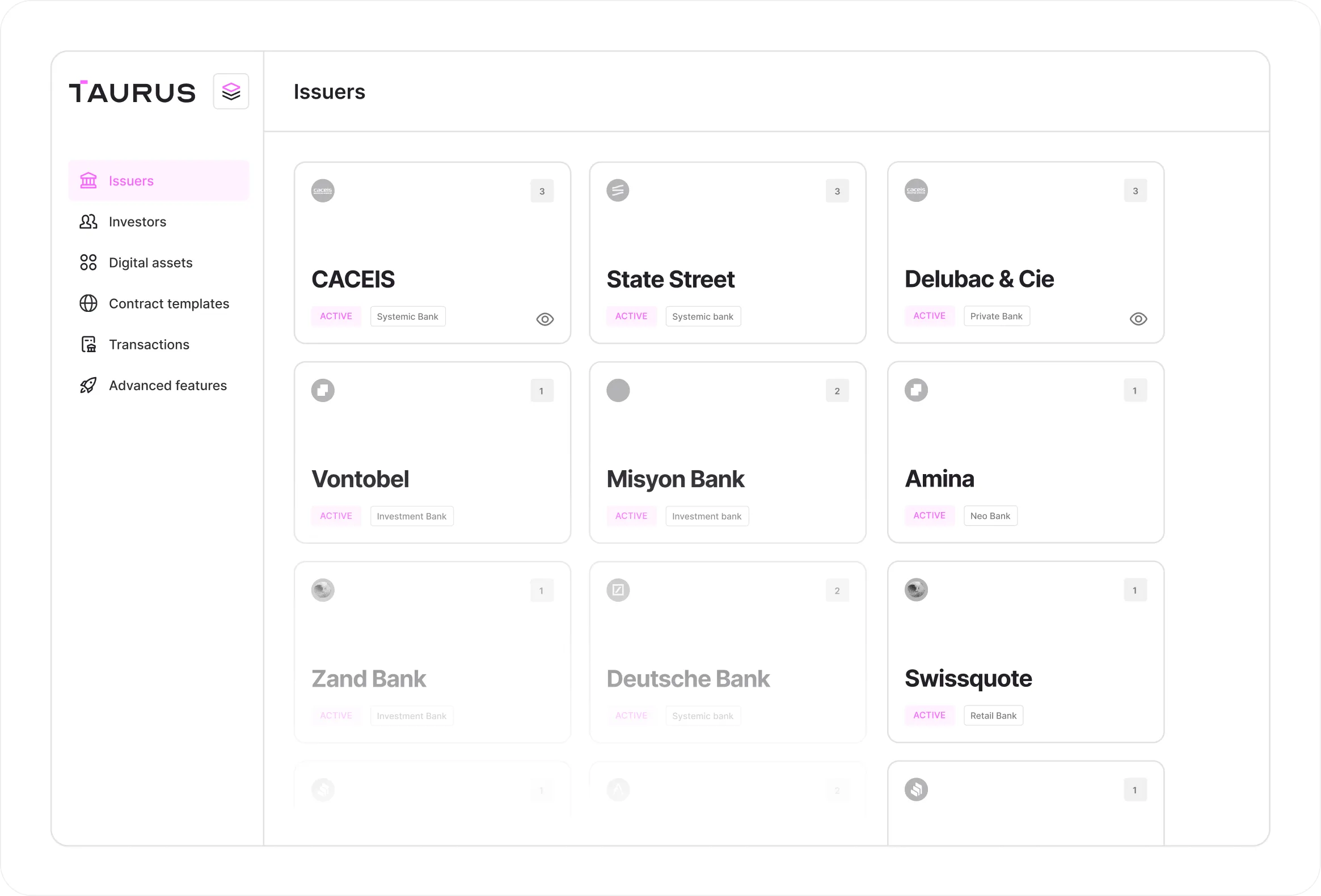

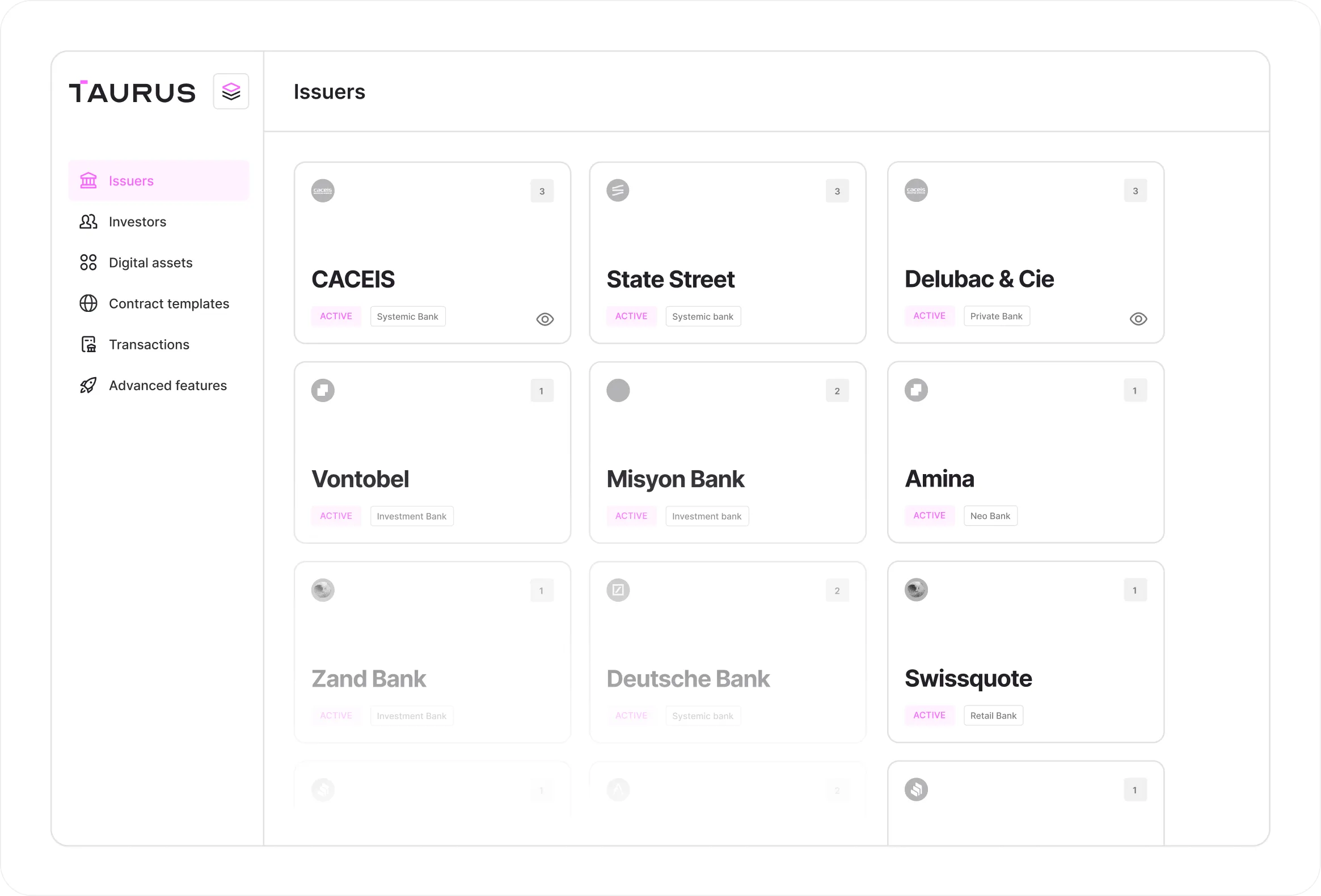

Used by the largest financial institutions across multiple jurisdictions

Tokenize asset easily on the standard of your choice on public and private blockchains.

Equity and debt: CMTAT (public & private), ERC1400, ERC3643, SPL

Real Estate and Art: NFT ERC721, ERC1155

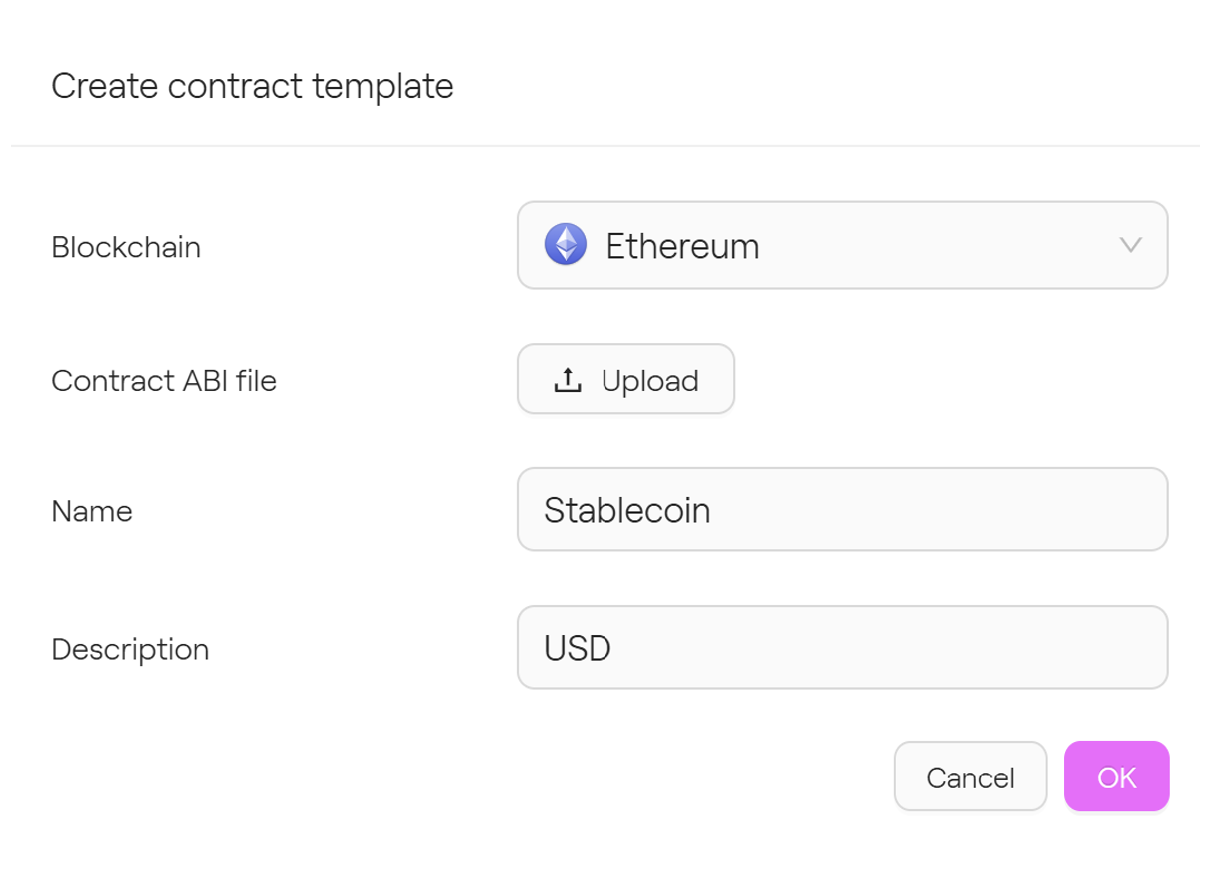

Stablecoins: custom ERC20

Upload and interact the smart contract of your choice: home-made or already issued.

Smart contract whitelisting

Automatic detection of smart contract functions

Govenance rules implementation

Implement the governance rules of your choice to mirror your target operating model.

At the smart contract deployment stage

At the smart contract function level

Off-chain and on-chain rules

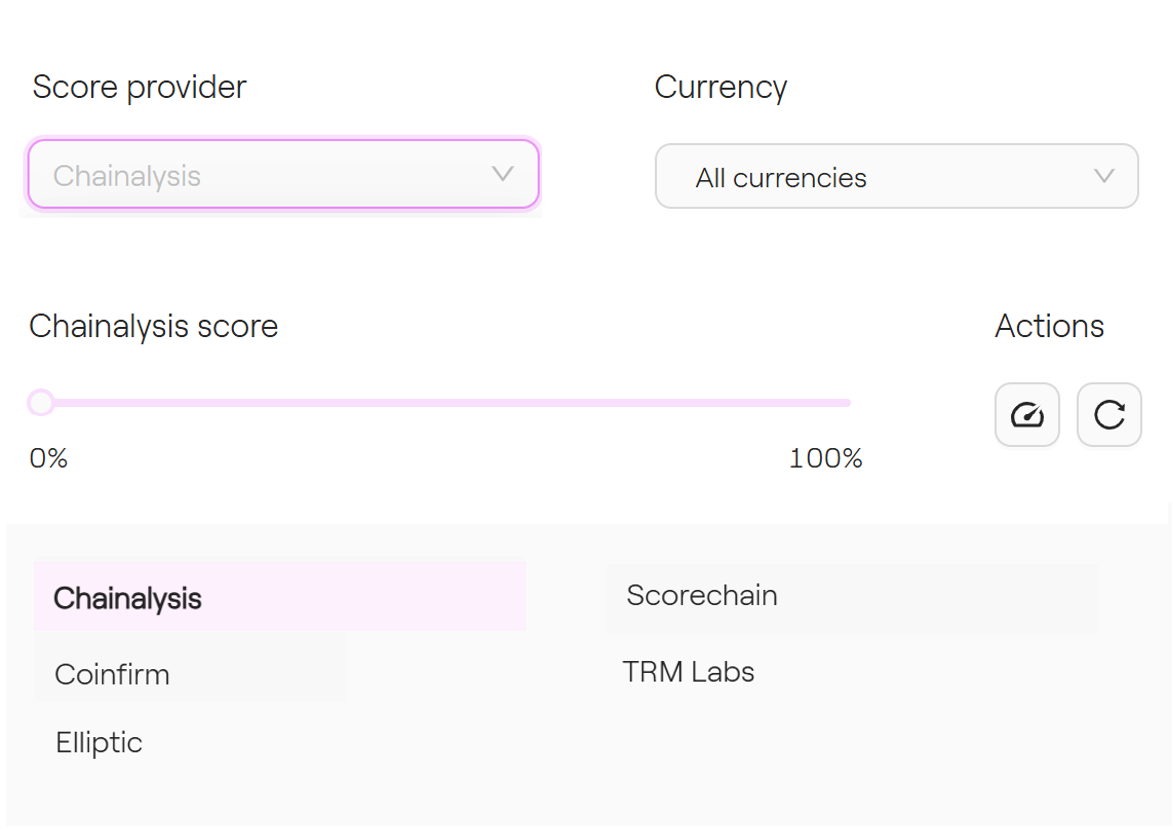

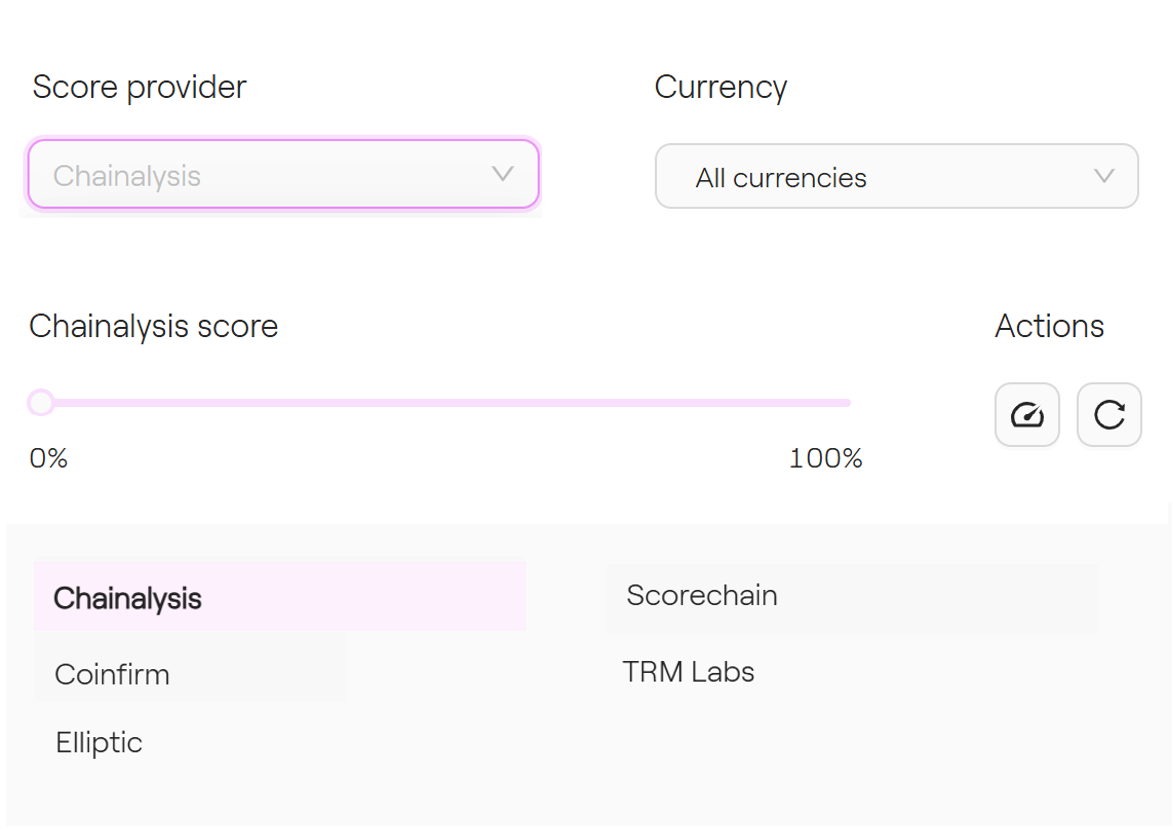

Ensure full compliance with applicable laws when issuing assets.

Multi-jurisdictions: fully configurable issuance workflow

Add legal and investor documentation off-chain

Audit trails

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Issue and service tokenized assets with the widest blockchain and smart contract coverage.

Why financial institutions select Taurus-CAPITAL tokenization

DLT securities: equity, debt, structured products, funds, real estate

Digital currencies: stablecoins, tokenized deposits, CBDCs

Collectibles

Issuance: deploy smart contracts securely

Lifecycle management: interact with any smart contract functions seamlessly

On-chain & off-chain governance rules

EVM protocols: Ethereum, Polygon, Optimism, Avalanche...

Non-EVM protocols: Stellar, Solana, ICP, Tezos...

Permissioned: Hyperledger BESU, Canton (soon), Quorum, etc...

Library of templates (CMTAT, ERC3643, ERC1400, SPL...)

Home-made smart contracts: upload your own with no limit

Third-party issued smart contracts: interact with no limit

Pre-integrated with Taurus-PROTECT for secure asset servicing.

End-to-end asset servicing rules fully configurable

Zero integration cost and engineering.

Highest security with smart contract deployment and functions calls processed in the HSM

Trust the highest security standards built for financial institutions.

Full audit trails for transparency

Advanced security: HSM, MPC, TSS ensure asset protection

Used by the largest financial institutions across multiple jurisdictions

Tokenize asset easily on the standard of your choice on public and private blockchains.

Equity and debt: CMTAT (public & private), ERC1400, ERC3643, SPL

Real Estate and Art: NFT ERC721, ERC1155

Stablecoins: custom ERC20

Upload and interact the smart contract of your choice: home-made or already issued.

Smart contract whitelisting

Automatic detection of smart contract functions

Govenance rules implementation

Implement the governance rules of your choice to mirror your target operating model.

At the smart contract deployment stage

At the smart contract function level

Off-chain and on-chain rules

Ensure full compliance with applicable laws when issuing assets.

Multi-jurisdictions: fully configurable issuance workflow

Add legal and investor documentation off-chain

Audit trails

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Why financial institutions select Taurus-CAPITAL tokenization

DLT securities: equity, debt, structured products, funds, real estate

Digital currencies: stablecoins, tokenized deposits, CBDCs

Collectibles

Issuance: deploy smart contracts securely

Lifecycle management: interact with any smart contract functions seamlessly

On-chain & off-chain governance rules

EVM protocols: Ethereum, Polygon, Optimism, Avalanche...

Non-EVM protocols: Stellar, Solana, ICP, Tezos...

Permissioned: Hyperledger BESU, Canton (soon), Quorum, etc...

Library of templates (CMTAT, ERC3643, ERC1400, SPL...)

Home-made smart contracts: upload your own with no limit

Third-party issued smart contracts: interact with no limit

Pre-integrated with Taurus-PROTECT for secure asset servicing.

Trust the highest security standards built for financial institutions.

Tokenize asset easily on the standard of your choice on public and private blockchains.

Upload and interact the smart contract of your choice: home-made or already issued.

Implement the governance rules of your choice to mirror your target operating model.

Ensure full compliance with applicable laws when issuing assets.

Experience is a priority for us

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending.

Simplify on-chain and fiat settlement operations while automating compliance tasks.

Why financial institutions select Taurus-CAPITAL tokenization

DLT securities: equity, debt, structured products, funds, real estate

Digital currencies: stablecoins, tokenized deposits, CBDCs

Collectibles

Issuance: deploy smart contracts securely

Lifecycle management: interact with any smart contract functions seamlessly

On-chain & off-chain governance rules

EVM protocols: Ethereum, Polygon, Optimism, Avalanche...

Non-EVM protocols: Stellar, Solana, ICP, Tezos...

Permissioned: Hyperledger BESU, Canton (soon), Quorum, etc...

Library of templates (CMTAT, ERC3643, ERC1400, SPL...)

Home-made smart contracts: upload your own with no limit

Third-party issued smart contracts: interact with no limit

Pledge funds in Taurus-PROTECT custody and trade seamlessly on Taurus-PRIME.

Facilitate syndicated loans, crypto-backed lending, and securities lending

Simplify on-chain and fiat settlement operations while automating compliance tasks