Important risk and regulatory disclosure about Taurus PRIME

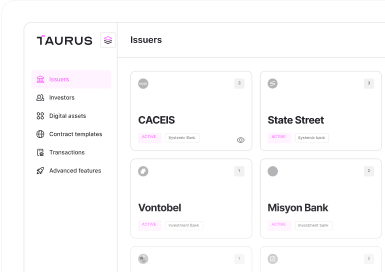

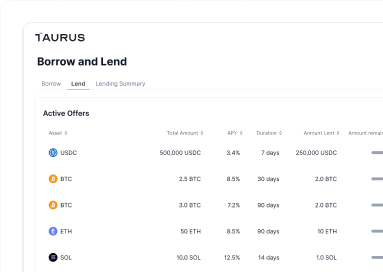

Taurus PRIME is a the digital assets OTC brokerage/trading, custody and staking service offered by Taurus SA.

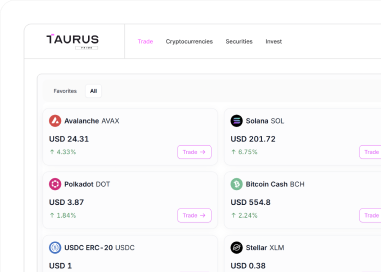

PRIME is Taurus’ electronic over-the-counter (OTC) trading service specifically designed for institutional or private clients requiring “high-touch” execution with minimal slippage. With PRIME, clients can enjoy OTC trading with our online platform, leveraging our institutional-grade infrastructure, segregated custody, and round-the-clock availability. Taurus uses an automated execution system sourcing the best price for the client among several counterparties to ensure best execution.

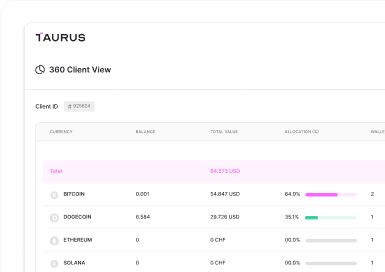

Clients’ digital assets on Taurus PRIME are held on a individual/segregated basis, in accordance with the Custody Regulations.

IMPORTANT RISK AND REGULATORY DISCLOSURE ABOUT TAURUS ARE PUBLISHED HERE.