Important risk and regulatory disclosure about Taurus SA

Taurus SA (“Taurus”) is a Swiss securities firm with registered address at Place Ruth-Bösiger 6, CH-1201 Geneva, Switzerland. It is authorised and supervised by the Swiss Financial Market Supervisory Authority (“FINMA”), Laupenstrasse 27, CH-3003 Bern, Switzerland.

As a securities firm, Taurus performs the following activites:

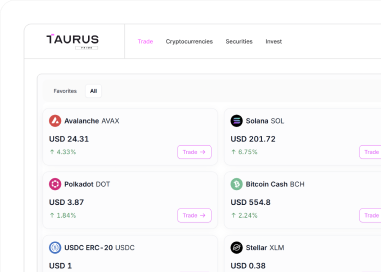

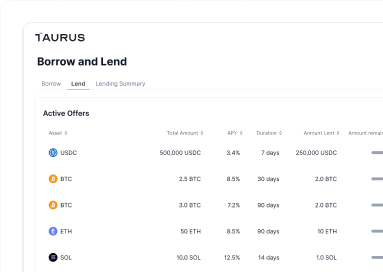

- Trading and brokerage of digital assets, securities and financial instruments for the account of clients and/or for its own account - this definition includes the acquisition or disposal of financial instruments, and the receipt and transmission of orders in relation to financial instruments

- Market-maker/liquidity-provider of digital assets, securities and financial instruments

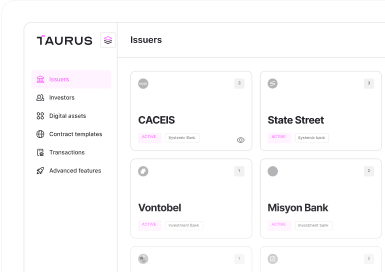

- Issuance house for digital assets, securities and financial instruments

- Operator of the Taurus Digital eXchange (“T-DX”) Organised Trading Facility

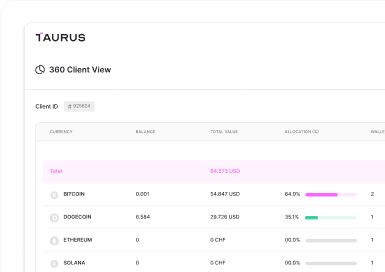

- Storage and custody of digital assets, securities and financial instruments for the account of clients and/or for its own account.

The above services are governed by dedicated Financial services terms and conditions. Moreover, Taurus develops proprietary digital asset IT infrastructure solutions and services and provides them according to the IT infrastructure and technology services terms and conditions.

Taurus offers financial services to all the client segments as defined in the Swiss Federal Act on Financial Services (“FinSA”):

- Retail clients;

- Professional clients; and

- Institutional clients.

Taurus provides financial services solely on an “execution-only” basis. Consequently, clients are informed that no appropriateness or suitability assessments are performed. More information about Taurus’ financial services under FinSA are available in the FinSA information brochure.

Taurus’ clients have the possibility of initiating mediation proceedings before the Swiss Chambers’ Arbitration Institution, a recognised ombudsman in accordance with Title 5 of FinSA.

Digital assets (incl. crypto currencies) held for clients are stored and custodied in accordance with the Custody Regulations, in particular articles 16 and 17.

Are clients’ deposits protected under the Swiss deposit insurance esisuisse? Yes, like any bank and any securities firm in Switzerland, Taurus SA signed the self-regulation “Agreement between esisuisse and its members”. This means clients’ deposits are protected up to a maximum of CHF 100,000 per client. Medium-term notes held in the name of the bearer at the issuing bank are also considered deposits. Depositor protection in Switzerland is provided by esisuisse, and the depositor protection system is explained in detail at esisuisse and on the FINMA website. Securities (incl. tokenized securities, DLT securities and ledger-based securities), credit balances not held in a government-issued currency (e.g. units of cryptocurrencies) and cryptocurrencies/digital assets held in a securities/custody account are not covered by esisuisse in accordance with its FAQ.

IMPORTANT RISK AND REGULATORY DISCLOSURE ABOUT T-DX ARE PUBLISHED HERE.